- USD/SEK currently trading at 8.4430 levels.

- It made intraday high at 8.4535 and low at 8.4335 levels.

- In the data front from Sweden, Country released its Unemployment rate with positive numbers at 7.5% m/m v/s 7.6% expected.

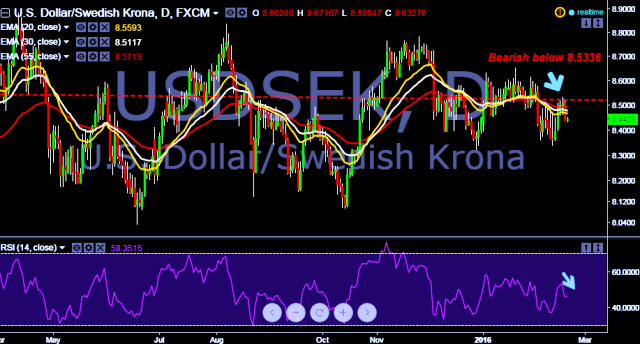

- Overall bias remains bearish till the time pair holds key resistance at 8.5188 levels.

- Alternatively, recent downfall will take the parity around key support area at 8.3382 levels.

- Key resistance levels are seen at 8.5188 and 8.5336 levels.

- Major support levels are seen at 8.4199, 8.4260 and 8.4078 levels.

We prefer to take short position in USD/SEK around 8.4450, stop loss 8.5188 and target 8.4078 levels.