The driving factor behind our long-term CHF view is Switzerland's inflation outlook which will allow the SNB to keep its nominal rates lowest in the world. It has reported its CPI MoM numbers at 0.1% from previous -0.2%.

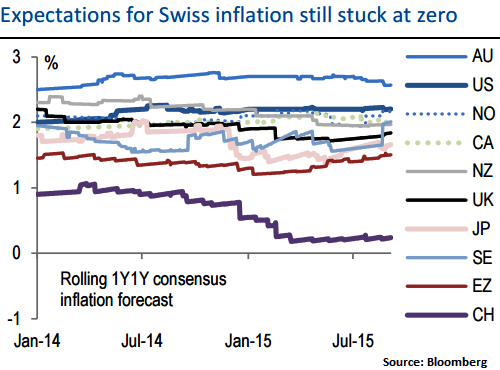

While its real rates are amongst the highest in G10, we have shown before those nominal rates are more important in driving spot FX returns. The above diagram shows updated 1Y1Y consensus expectations (year ahead inflation, 12 months out).

By 2016, Switzerland is expected to be the only G10 country with inflation still hugging zero. The SNB does not expect inflation to turn positive until early 2017 and it expects to keep rates at -0.75% throughout the forecast horizon. But the combination of previous CHF appreciation, lower commodity prices and slack in the economy all conspire to keep inflation soft and CHF slowly trending lower.

European rates are now expected an extension to ECB QE in Sept 2016 which should flatten the path for EUR/CHF next year.

Switzerland finally moves out of deflation zone

Tuesday, October 6, 2015 1:10 PM UTC

Editor's Picks

- Market Data

Most Popular

China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength

China Sets 2026 Growth Target at 4.5–5% While Prioritizing Innovation and Industrial Strength  Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply

Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply  China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI

China Factory Activity Surges to Five-Year High as Demand Boosts Manufacturing PMI  Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion

Gold Prices Steady in Asian Trade as Strong Dollar and Rising Yields Weigh on Bullion  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks

Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks  Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise

Australia’s Economy Accelerates in Q4 2025 as Household Spending and Government Investment Rise  Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility

Dollar Hits Three-Month High as Middle East Conflict Drives Energy Prices and Market Volatility  EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy

EU Seeks Stronger Canada Trade Ties Amid Uncertainty Over U.S. Tariff Policy  The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’

The Pentagon strongarmed AI firms before Iran strikes – in dark news for the future of ‘ethical AI’  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty