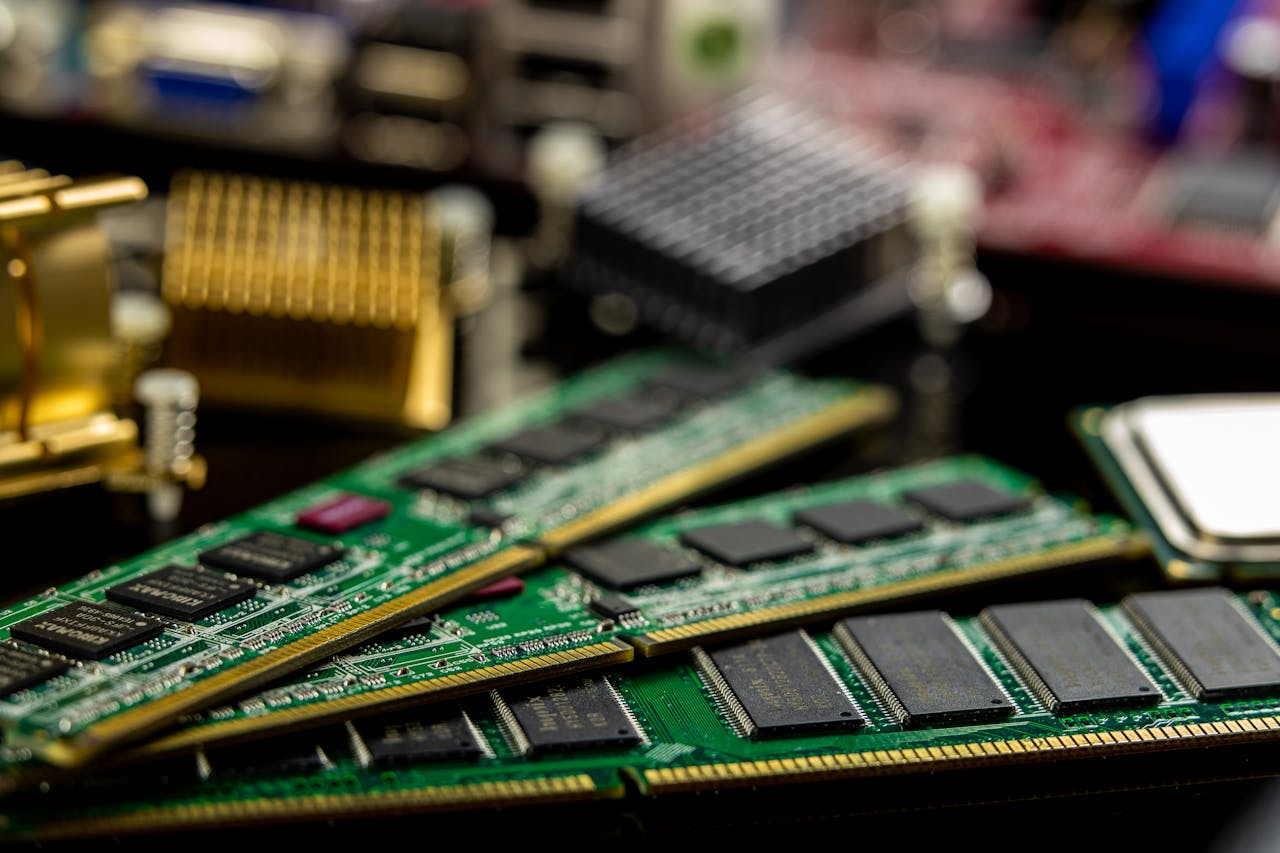

Taiwan has sent officials to Washington to discuss potential U.S. tariffs, Economy Minister Kuo Jyh-huei confirmed. This follows concerns that President Donald Trump may impose tariffs on imported semiconductors, targeting Taiwan’s booming chip industry. Taiwan is home to TSMC, the world’s largest contract chipmaker, and a key player in the global semiconductor market.

Trump, who has accused Taiwan of taking U.S. semiconductor business, announced plans to impose reciprocal tariffs on multiple economies, with details expected soon. Taiwan, running a large trade surplus with the U.S., saw its exports surge 83% last year to a record $111.4 billion, largely driven by semiconductor shipments.

To address the issue, Taiwan dispatched a deputy minister and a deputy section chief to Washington. Kuo emphasized that these officials will explain the importance of Taiwan’s chip industry to U.S. policymakers, highlighting the "win-win" relationship between both nations.

Taiwan is also considering increasing U.S. energy imports to balance trade relations. Kuo pointed to Japan’s move to boost liquefied natural gas (LNG) imports from the U.S. as a potential model. Currently, Taiwan relies on Australia and Qatar for most of its LNG needs.

As trade tensions escalate, Taiwan aims to maintain its strong partnership with the U.S. while safeguarding its vital semiconductor industry.

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy

Jack Lang Resigns as Head of Arab World Institute Amid Epstein Controversy  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border

Nighttime Shelling Causes Serious Damage in Russia’s Belgorod Region Near Ukraine Border  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges

Ohio Man Indicted for Alleged Threat Against Vice President JD Vance, Faces Additional Federal Charges  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Pentagon Ends Military Education Programs With Harvard University

Pentagon Ends Military Education Programs With Harvard University  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify

Netanyahu to Meet Trump in Washington as Iran Nuclear Talks Intensify  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales

Trump Signs “America First Arms Transfer Strategy” to Prioritize U.S. Weapons Sales