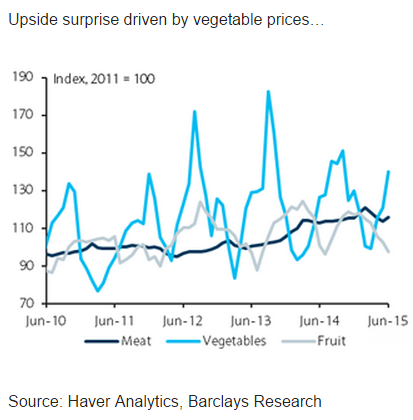

Inflation ticked up to -0.56% y/y in June (May: -0.73%; Apr: -0.82%), slightly above the forecast and consensus (-0.7%). On a seasonally adjusted m/m basis, the CPI rose 0.17% (May: 0.05%; Apr: -0.14%). Overall, the upside surprise in headline inflation was driven by higher food prices (Jun: 10.8% y/y; May: 8.7%) on the back of excess rainfall in June.

Indeed, given limited supply, prices of cabbage surged 77% m/m in June. This helped offset the distortion from lower oil prices, which continued to weigh on utility and gasoline prices. All told, still no deflationary risk is seen, as core inflation continues to be supported from solid domestic demand. This is also consistent with the path of services inflation, which remained resilient at 0.8% in Jun (May and Apr: 0.9%).

"We recently lowered our 2015 inflation forecast by 40bp, to -0.10%, as we expect oil distortion to extend into H2, albeit with a smaller drag, given that international oil prices have stayed rangebound. We maintain our 2016 inflation forecast at 2.1%, on account of a low base and subsequent pickup in oil prices",says Barclays.

Inflation is expected to rise gradually in H2, helped by stable oil prices. More importantly, food prices are also likely to trend higher due to warmer and drier weather from the El Niño weather pattern, as well as the upcoming typhoon season. As such, today's print should not concern the CBC.

Given the the outlook for growth remains constructive, especially towards Q3, the CBC has continued to reduce its support for the economy. Excess liquidity was TWD27.2bn/day in May, lower than the average between January to April of TWD36.8bn. As such, rate normalization is expected to begin in December this year.

Taiwan inflation bottoms as rains push up food prices

Tuesday, July 7, 2015 2:22 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed