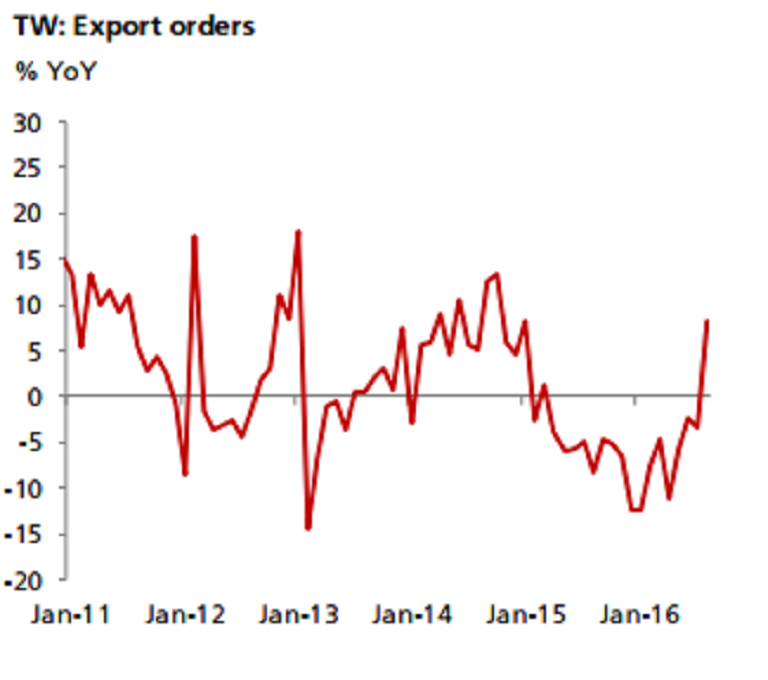

Taiwan’s export orders surprised financial markets on the upside during the month of August, following strong demand from China that lent suitable support to the country’s overseas trade. The low base effect could partly explain why orders rose sharply on an annual basis, across markets, and across all the major products.

Taiwan’s headline export orders growth registered 8.3 percent y/y, a big jump compared to -3.4 percent in July and the 2Q average of -6.4 percent. The month-on-month growth in export orders was also strong, at 5.5 percent, at a seasonally adjusted basis. This is directly attributable to the latest iPhone 7 series’ launch effect.

Further, on a monthly basis, orders for electronics rose 16.5 percent, while that of information & communication products jumped 10.1 percent, surging the most in August. Market wise, strong demand was seen from China at 11.2 percent and from the United States at 8.6 percent, where the iPhone supply chains are most concentrated.

However, there remain two latent concerns. First, the rise in export orders may not boost domestic manufacturing output by a similar extent, given a high proportion of overseas production by Taiwanese manufacturers. In contrast with the strong results in export orders, manufacturing PMI has only improved modestly to 51.8 as of August.

Second, the iPhone-driven recovery will not be sustainable. The past experiences showed that the iPhone effect usually last for just 1-2 quarters. If history is a useful guide, a renewed slowdown will likely occur in 1H17. Having said that, August export orders data is still enough to support the case of higher (better-than-expected) GDP growth in 3Q, DBS reported.

Meanwhile, this is likely to reduce the pressure for the central bank to further ease monetary policy. Rate decisions at next week’s CBC meeting now appear to be a close call, the report added.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election