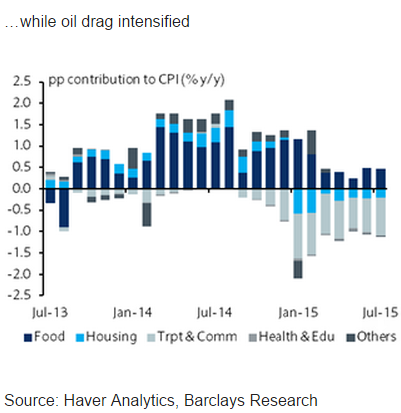

Taiwan's inflation edged further into the negative territory at -0.66% y/y in July (Jun: -0.56%; May: -0.74%), broadly in line with consensus. Overall, the path of inflation mainly reflected the renewed downward pressure on international oil prices, with the Brent falling by 12% on average in July. Meanwhile, the shock to food prices due to excess rainfall last month subsided, while the typhoon in early July seemed to have little impact on the food prices. This led to oversupply in vegetables, with prices falling by 4.9% m/m in July. Core inflation edged up to 0.66% y/y in July (Jun and May: 0.59%), supported by higher entertainment prices.

"We still see no deflationary risk, as core inflation will likely continue to be supported by solid domestic demand. Indeed, the release of Q2 GDP showed no signs of any slowing in domestic consumption, with private consumption growing at a solid pace of 2.8% y/y in Q2 (Q1: 2.5%). As such, we maintain our 2015 inflation forecast at -0.1% and expect inflation to rebound to 2.1% in 2016, on account of a low base and subsequent pickup in oil prices," notes Barclays.

Inflation is expected to recover gradually in H2, helped by a low base in Q4. Food prices are also likely to trend higher due to warmer and drier weather from the El Nino episode, as well as the upcoming typhoon season.

The markedly weaker-than-expected Q2 GDP print will likely alter the CBC's stance on its liquidity management, which was TWD25.2bn/day in June, lower than the average of TWD34.9bn between January and May. As a signal that it is doing more to support growth, the CBC could maintain excess liquidity in the economy at a slightly higher range in the coming months. Beyond that, the CBC will defer to the government stimulus program that was announced on 27 July.

"Soft CPI should not be of any concern to CBC, given it is mainly supply-side driven and we maintain our call for the CBC to stay on hold at its September meeting. The much weaker Q2 outturn prompted to us lower our 2015 growth forecast to 2.0% (previously: 3.7%). We also pushed back our rate normalisation forecast by two quarters and now expect the CBC's first rate hike of 12.5bp in June 2016," added Barclays.

Taiwan's renewed pressure on oil pushes inflation lower

Wednesday, August 5, 2015 2:41 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022