Taiwan's fresh food prices climbed strongly in September, recording double-digit growth for a second consecutive month and raising headline CPI out of the negative zone earlier than expected.

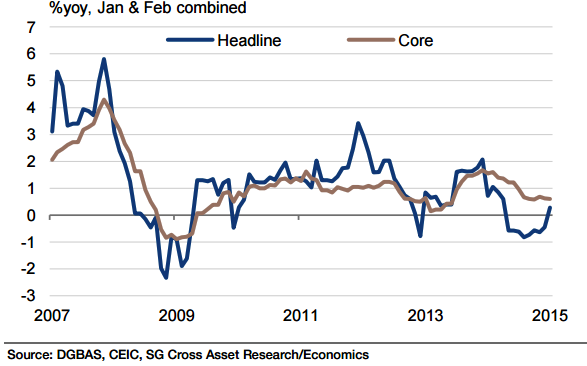

This is mainly due to the three tropical cyclones that hit the island in August and September, compared with only one over the same period last year. However, underlying inflationary pressures have continued to soften.

"The services CPI reading came in at its weakest level in 19 months in September. Against the backdrop of weakening growth momentum and weakening wage growth, the core inflation is expected to soften further, even though the weaker currency is likely to introduce some imported inflation", says Societe Generale.

The soft growth and inflation outlook argues for more easing. However, the benefits of further monetary easing would likely be marginal. We note that central bank liquidity withdrawals have accelerated even after the monetary easing.

"This highlights the ample liquidity in Taiwan's banking system. Whether a further cut could raise appetite for more capex is questionable amid soft growth expectations. All in all, the central bank is likely to stay put in December", added Societe Generale.

Taiwan’s underlying inflationary pressures to ease further

Friday, October 30, 2015 10:26 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022