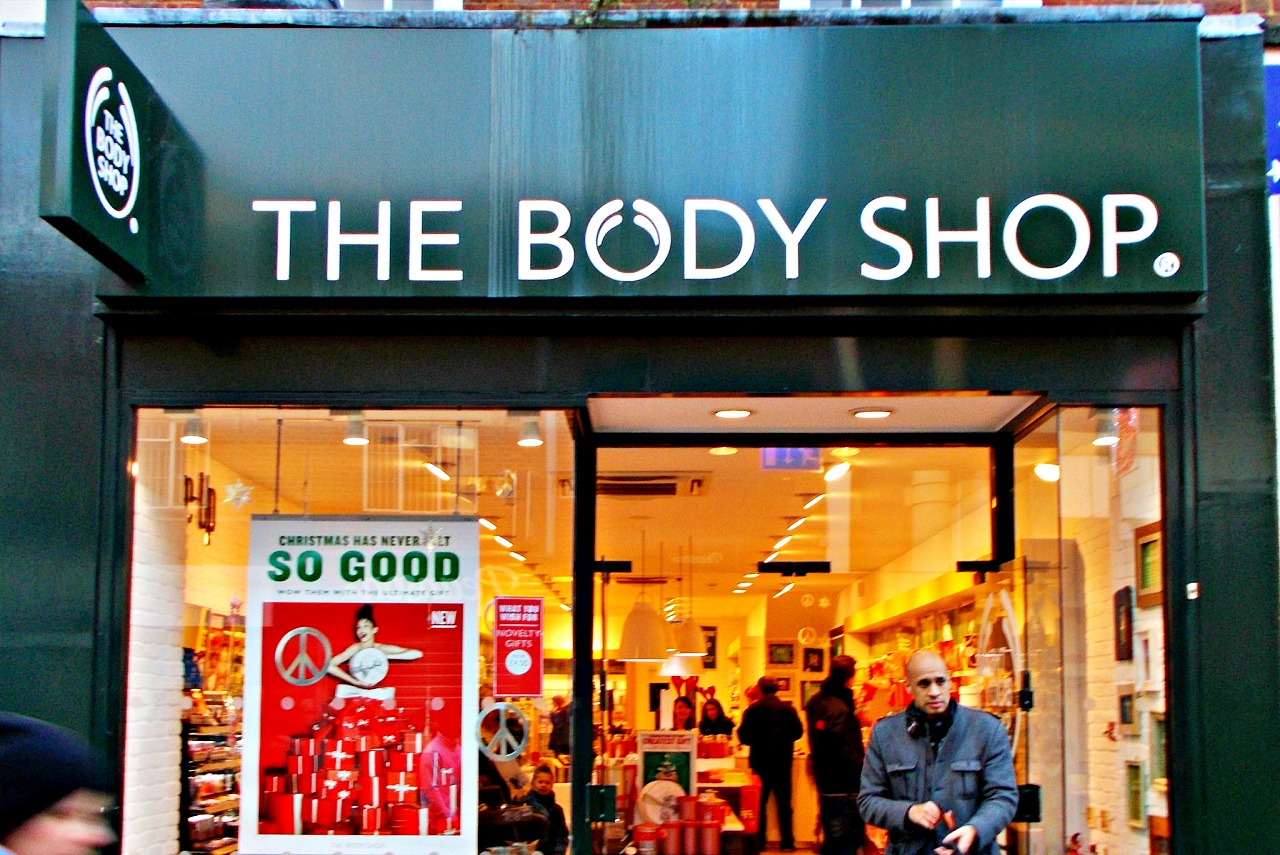

The Body Shop International Limited is in talks with the Aurelius Group for a possible acquisition deal. Based on the report, people familiar with the matter said the latter may buy the British cosmetic store chain.

The Aurelius Group Asset management company headquartered in Grünwald, Germany, may acquire The Body Shop from Natura & Co Holding SA. As per Bloomberg, the deal could be signed as early as November.

Aurelius Group’s Takeover Bid

The acquisition deal may be confirmed next month after other bidders, such as Alteri Investors and Elliott Advisors, were reportedly taken off the list and leaving Aurelius. The transaction could be valued between £400 million to £500 million.

According to Sky News, the first to publish the report, the ongoing negotiations between the companies are expected to result in an official buyout deal. It was during the summer when Natura & Co Holding placed The Body Shop on the market. In any case, it was said that Natura & Co. started to explore the sale to reduce costs after buying The Body Shop from L’Oreal in June 2017.

Aiming for the Completion of the Deal This Year

Currently, the firm hired Morgan Stanley to handle the transactions related to the acquisition. It was added that the main goal is to complete the deal before this year ends. Reuters reported that If the takeover of The Body Shop proceeds, the sale price may still be reduced and probably lower than the $485.20 million to $606.50 million suggested value.

At any rate, this buyout will further expand the Aurelius Group’s business portfolio after buying the Foortasylum streetwear and sportswear chain. The company bought this after the competition board ordered JD Sports to sell it. The Germany-based firm also owns the Lloyds Pharmacy group.

Photo by: Tony Monblat/Flickr (CC BY-SA 2.0)

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate

Anthropic Eyes $350 Billion Valuation as AI Funding and Share Sale Accelerate  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns

FDA Targets Hims & Hers Over $49 Weight-Loss Pill, Raising Legal and Safety Concerns  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns