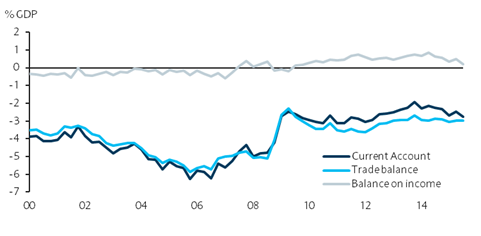

The US current account deficit widened modestly in Q3 15, to $124.1bn from a revised $111.1bn in Q2. Forecast ($126.0bn) and the consensus ($118.6bn) had looked for such widening in line with the monthly trade statistics.

This increase in the current account deficit primarily reflects a decline in the balance on primary and secondary income. Primary income fell $6.6bn, to positive $46.1bn. Secondary income declined nearly $6.0bn, reaching negative $36.6bn.

"The balance on goods remained negative, reflecting the ongoing increases in imports to the US, as import prices fall and volumes increase. On the month, however, the goods deficit widened less than $1bn. Overall, the current account deficit widened to 2.7% of GDP in Q2 from 2.5% in Q2", says Barclays.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX