U.S. exports have posted a soft showing thus far in 2015. Through August, the most recent month for which numbers are available, real exports have fallen by 3.3%, and nominal exports are lower by 8%. Although economic theory and models would attribute much of the weakness in exports to the appreciating USD, digging through the 2015 trade figures leads to a somewhat more nuanced conclusion: soft demand from select countries that are in the midst of economic slowdowns is responsible for the lion's share of the decline in demand for U.S. produced goods, and it's hard to disentangle the currency aspect of reduced demand for U.S. goods from the broader economic weakness being experienced among large U.S. trade partners, according to Scotiabank.

Federal Reserve Vice Chair Fischer has cited the Fed's SIGMA model as an appropriate framework for analyzing the impact of currency appreciation on the trade balance.* According to SIGMA, a 10% appreciation of the real USD would cause a roughly 25bps drag on growth during the first year following the move and as much as a 70bps drag in the second year. (These results are taken from Vice Chair Fischer's presentation of Aug. 29 at Jackson Hole.) Given that the broad real trade weighted USD appreciated by 10% during the second half of 2014 and an additional 5% during the past six months, the implication is that trade could drag on growth this year by a bit less than 40bps and more than 100bps in 2016. The factors that differentiate SIGMA from other models are: a) import prices react rapidly to shocks (i.e. a change in the exchange rate) and b) real output can be fairly volatile. These attributes make SIGMA a perhaps more realistic model than many of its predecessors, explain why policy makers are currently relying on it, and finally, explain why market participants are paying attention to these forecasts from policy makers.

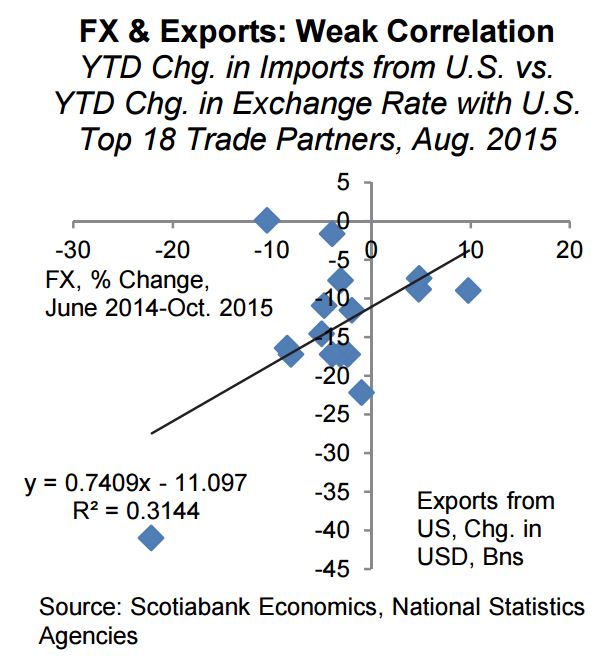

The data on trade for this year at first confirm the intuition embedded in SIGMA's projections and the Vice Chair's comments. As chart 1 to the right indicates, exports have fallen markedly this year. The complicating factor is that when one digs under the hood of the export data for 2015, one discovers that exports have not weakened uniformly or in proportion to changes in currency exchange rates. On the contrary, as chart 2 demonstrates, the weakest exporting countries have also been those with the weakest economies. The biggest dollar value declines in exports in 2015 have been with Canada (25.5% of the declines), China including Hong Kong and Taiwan (9.2%), and Brazil (9.3%). While both CAD and BRL have depreciated strongly against the USD, China's currency exchange rate is fixed and was only managed modestly lower in August 2015. Moreover, those countries have seen overall demand soften considerably as growth in Canada and Brazil stagnated, and growth in China has at a minimum slowed. As chart three to the right shows, the currency relationship is directionally powerful, but by no means fully explanatory.

The point is that economic weakness in some of the United States' principal trading partners seems to be at least as relevant of a cause of weak exports this year as the USD - even if the USD is probably playing a role in dampening U.S. exports too. Moreover, currency exchange rates are at least to some extent a function of relative economic performance.

According to Scotiabank, there are two potential implications that one might draw from the conclusion that soft foreign demand has played a big role in U.S. trade balance performance this year: a) U.S. growth is about to be restrained somewhat further as the drag from the USD starts to be felt in 2016, but b) this could be overwhelmed by a potential snap-back in demand from key U.S. trade partners should their economies recover. Of course, if there is no snap back in Canada or China, and global growth remains restrained next year, then the least of the United States' problems will be the stronger dollar.

The USD not the only reason for U.S. export slowdown

Sunday, October 11, 2015 11:33 AM UTC

Editor's Picks

- Market Data

Most Popular

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close

Goldman Predicts 50% Odds of 10% U.S. Tariff on Copper by Q1 Close  US Gas Market Poised for Supercycle: Bernstein Analysts

US Gas Market Poised for Supercycle: Bernstein Analysts  Bank of America Posts Strong Q4 2024 Results, Shares Rise

Bank of America Posts Strong Q4 2024 Results, Shares Rise  U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge

U.S. Banks Report Strong Q4 Profits Amid Investment Banking Surge  S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays

S&P 500 Relies on Tech for Growth in Q4 2024, Says Barclays  China’s Growth Faces Structural Challenges Amid Doubts Over Data

China’s Growth Faces Structural Challenges Amid Doubts Over Data  Moldova Criticizes Russia Amid Transdniestria Energy Crisis

Moldova Criticizes Russia Amid Transdniestria Energy Crisis  European Stocks Rally on Chinese Growth and Mining Merger Speculation

European Stocks Rally on Chinese Growth and Mining Merger Speculation  Urban studies: Doing research when every city is different

Urban studies: Doing research when every city is different  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  2025 Market Outlook: Key January Events to Watch

2025 Market Outlook: Key January Events to Watch  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX