EURJPY has been consolidating in a narrow range between 173.02 and 170.96 for the past five days. It hits an intraday high of 172.62 and is currently trading at approximately 172.39. Intraday outlook remains bullish as long as support 169.75 holds.

Technical Analysis:

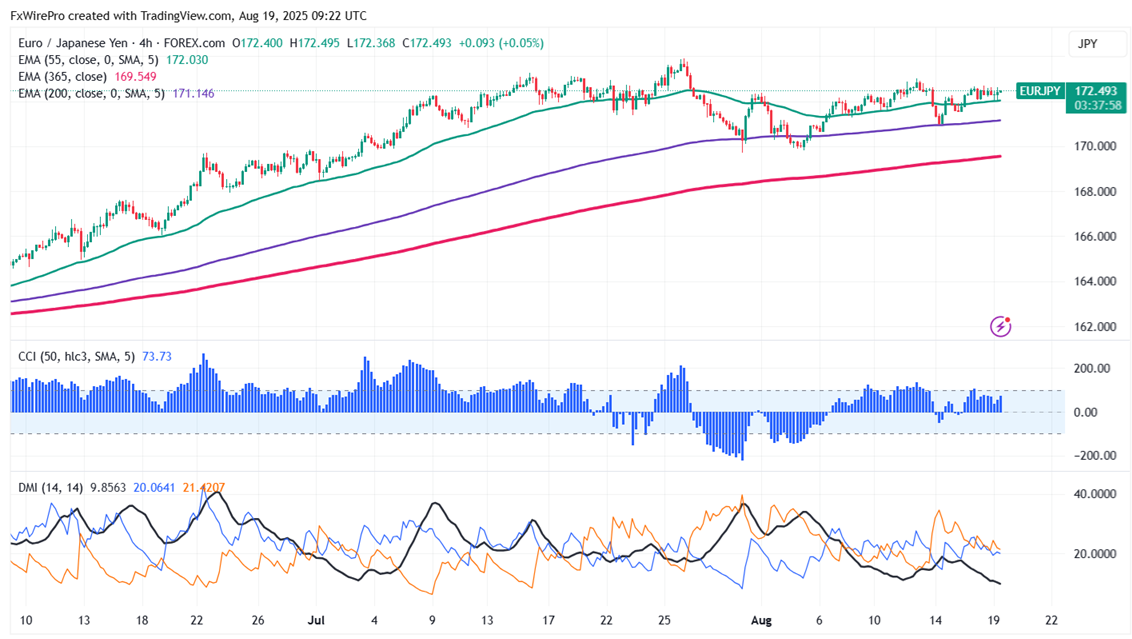

The EUR/JPY pair is trading below 55 EMA, 200, and 365-H EMA on the 1-hour chart.

- Near-Term Resistance: Around 173, a breakout here could lead to targets at 173.89/174/175.

- Immediate Support: At 171.80 if breached, the pair could fall to 171.15/170.80/169.70/169/168.70/168.45/168.

Indicator Analysis 4-hour chart): - CCI (50): Bullish

- Average Directional Movement Index: Neutral

Overall, the indicators suggest a bearish trend

Trading Recommendation:

It is good to buy on dips around 172 with a stop loss at 171 for a TP of 169.70/168.