There has been plenty to mull over in the past week, including the recently announced new property tax rules, a mildly stimulatory Budget, and surprisingly resilient inflation expectations.

We remain firmly of the view that an OCR cut in June is unlikely, although where the OCR heads later in the year is a closer call.

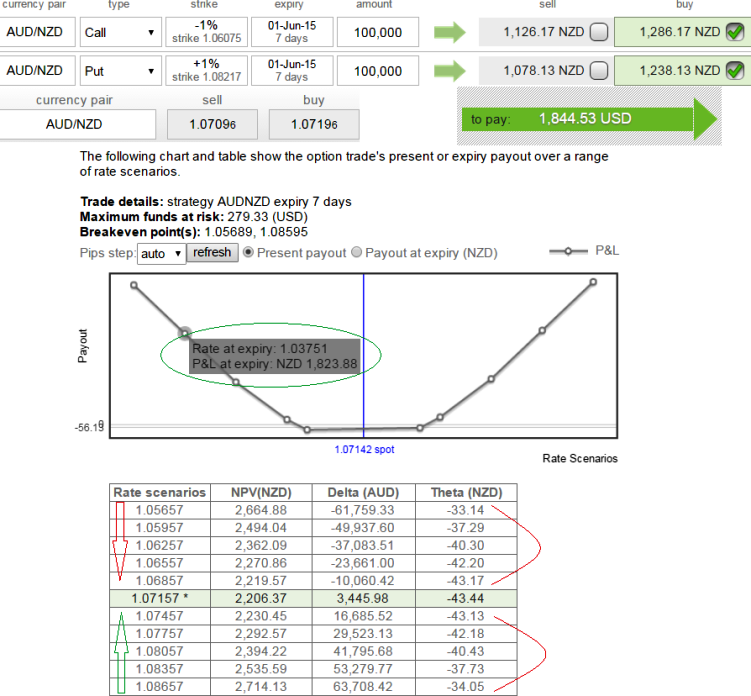

Theta indicates time decay merits on either side of Long Guts of AUD/NZD:

Option basket: Long Guts (AUD/NZD)

The long guts is a neutral strategy in options trading that involve the simultaneous buying of an ITM call option and an ITM put option of the same underlying currency and expiration date.

As shown in the figure, there is no significant change in theta value even though the underlying exchange rate oscillates dramatically. Theta has not been that sensitive to option's value to the passage of time.

Usually for ITM call option, as time to expiry draws nearer, Theta lowers and decreases. In this case of long guts on AUDNZD pair relative change is not significant.

This is an unlimited profit, limited risk strategy that is taken when the options trader thinks that the underlying stock will experience significant volatility in the near term.

The long guts are a debit spread as a net debit is taken to enter the trade.

Large gains for the long guts strategy is attained when the underlying stock price makes a very strong move either upwards or downwards at expiration.

The move in the underlying stock price must be strong enough such that either the long call or the long put rise enough in value to offset the loss incurred by the other option expiring worthless.

Time decay (Theta) merits of Long Guts position on AUD/NZD

Monday, May 25, 2015 12:35 PM UTC

Editor's Picks

- Market Data

Most Popular

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary