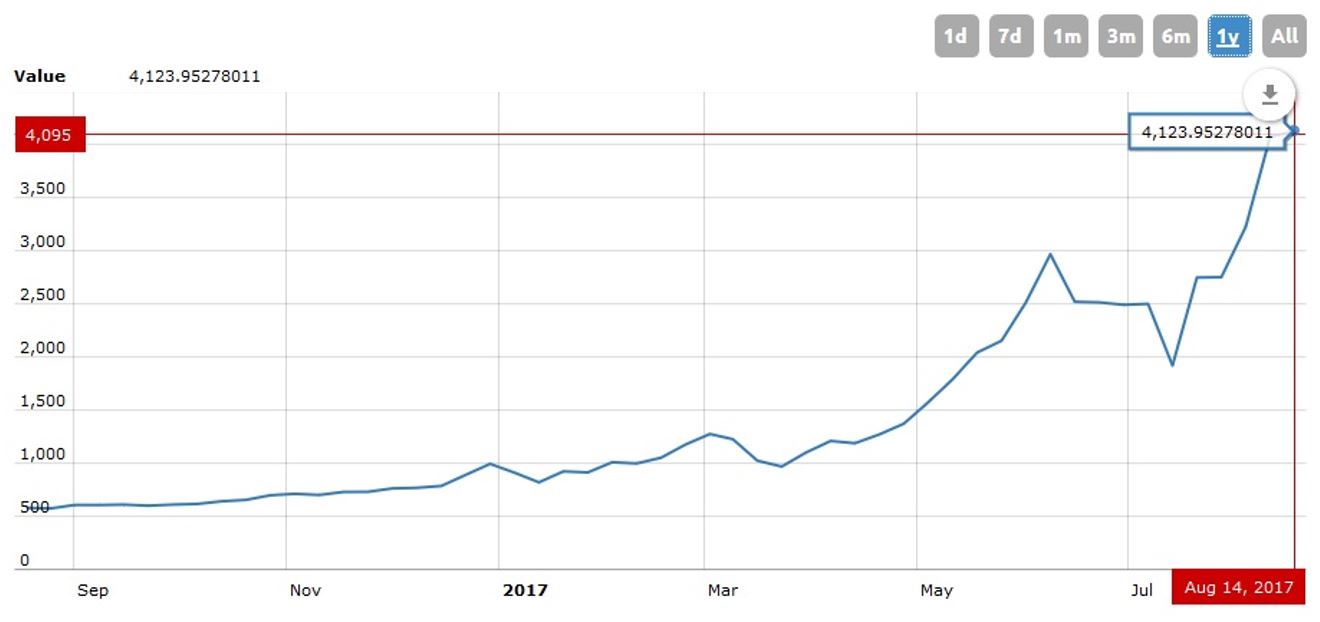

As at Wednesday, 16 August 2017, 1 BTC was trading at $4,125.09. This digital currency has a market capitalization of $68.10 billion, with some 16.50 million Bitcoin in circulation. A year ago, BTC was trading at $579.23 per unit. That represents a 7-fold increase in the value of this cryptocurrency in just a year. That statistic is remarkable, given that the performance of US bourses has been far less spectacular. Consider the following growth rates on Wall Street:

- The Dow Jones Industrial Average has a 1-year return of 22.03%

- The S&P 500 Index has a 1-year return of 15.82%

- The NASDAQ Composite Index has a 1-year return of 22.91%

The rapid rise in Bitcoin’s value is attributed to several factors, notably the increased popularity of blockchain technology. Blockchain technology does not have a single point of failure like a server at a bank, or at Amazon, or eBay, which conducts transactions. Since there are multiple nodes in the network, it is not controlled by an individual entity – it is controlled by everyone on the network. It is safe, secure and allows for rapid processing of transactions.

Blockchain technology such as Bitcoin, does not require intermediaries to broker transactions – only buyers and sellers are needed, and everything is 100% transparent on the peer-to-peer network. While there have been several criticisms of this unregulated digital currency, it is proving to be a highly sought-after contrarian investment option for many people in their financial portfolios. Bitcoin production will be limited to 21 million coins, at which time no further BTC will be produced. It is not backed by gold, central banks or governments – meaning that it is completely virtual (digital) and is subject to demand/supply considerations.

Who Foresaw the Rapid Rise of Bitcoin?

Montgomery Adel Taub, senior financial analyst at Trade-24 was one of the first experts to offer predictions about the meteoric growth of Bitcoin. In April 2016, Adel Taub penned an email to a colleague indicating the following, ‘I believe we should start making accommodation for cryptocurrency a.k.a. Bitcoin in our weekly mailers to clients. It is my opinion that the Brexit saga and other geopolitical uncertainties are going to bring about a paradigm shift in investment practices.… our clients are going to be increasingly interested in this digital currency phenomenon which I foresee rising well above $4,000 by 2018. These moves will likely be brought about by regulation of cryptocurrency trading in Asia, and widespread adoption in the financial sector.’

The rapid rise in BTC’s trading price has taken most everyone unawares. In July 2010, BTC was trading at $0.06 per unit, and remained relatively flat through 2013. It spiked to $979.45 per unit on 25 November 2013, but gradually tapered off towards a low of $238.49 by January 2015. Bitcoin then entered a consolidation phase where it hovered around $240 per unit until December 2015 when it edged towards $455 +. There cryptocurrency’s meteoric rise has been relatively uninterrupted since 2016. The sharpest growth took place in March 2017 and Bitcoin jumped from $1,061 to a high of $2,851 by June 5, 2017. It retreated briefly towards $2,236.67 on 10 July, before virtually doubling to $4,247.40 per unit on August 14, 2017.

Regulatory approval helps BTC Rise

Various events have assisted BTC along the way. Foremost among them are regulatory approval in the Philippines and South Korea, and a Swiss bank recently agreed to sell BTC and Ether to clients. The cryptocurrency has been boosted dramatically by traders in Japan, especially as tensions between the US and North Korea grow. In this vein, it has functioned similar to safe-haven assets like gold, although digital currency is inherently more volatile than physical commodities like gold, and fiat currencies like the USD, GBP, EUR, JPY and others.

The opinions expressed in this article do not represent the views of EconoTimes.

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences

CK Hutchison Launches Arbitration After Panama Court Revokes Canal Port Licences  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026