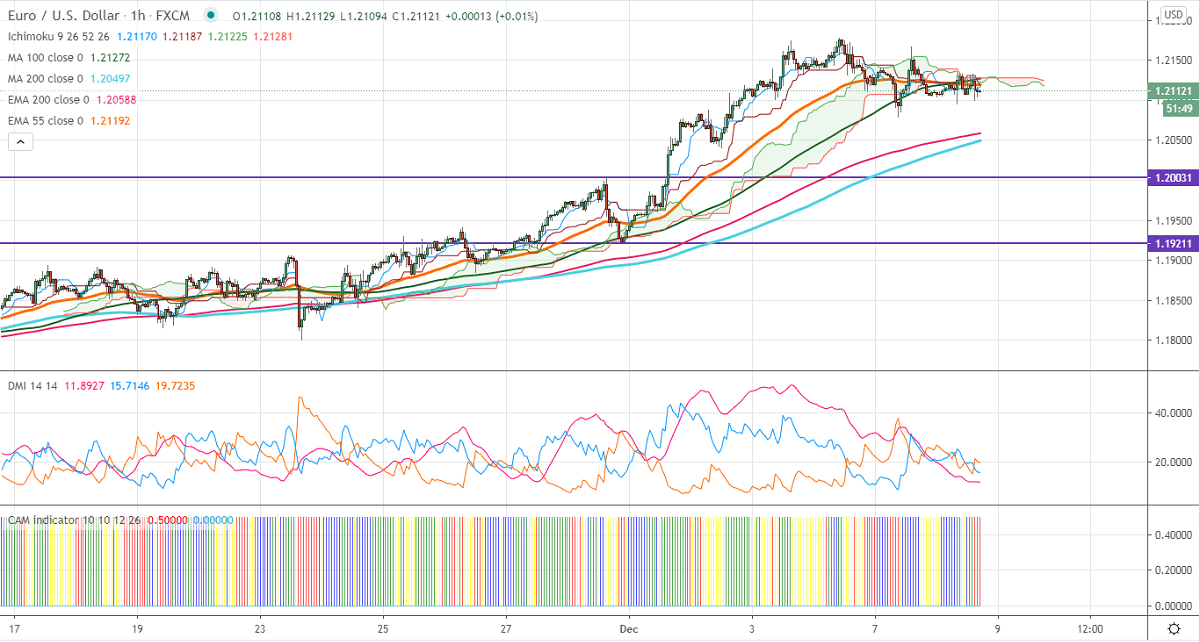

Ichimoku analysis (Hourly chart)

Tenken-Sen- 1.2117

Kijun-Sen- 1.2130

EURUSD declined more than 50 pips after hitting a fresh multi-year high at 1.21775. The pair was one of the best performers in the previous month and jumped nearly 350 pips on broad based US dollar selling. The COVID-19 vaccine optimism and stimulus hopes have decreased demand for Safe-haven assets like the US dollar. German ZEW sentiment came at 55 in December vs forecast of 45.20.DXY is trading below the 91 levels; Any minor bullishness only above 91.50. Short term trend of EURUSD is bullish as long as support 1.2040 holds.

Technical:

EURUSD is hold trading slightly below 100- H MA at 1.2126; any convincing break below 1.2075 confirms the minor weakness. A dip till 1.2040/1.2000 possible. On the higher side, the near term significant resistance is around 1.21780 and any indicative break above that level will take till 1.2200/1.2250.

It is good to buy on dips around 1.2080 with SL around 1.2040 for the TP of 1.2200.