Since Australia is on the verge of many data announcements this week, Aussie dollar's any dramatic fluctuations can be taken into your control by deploying the below strategy.

Option basket: Long Guts (AUD/NZD)

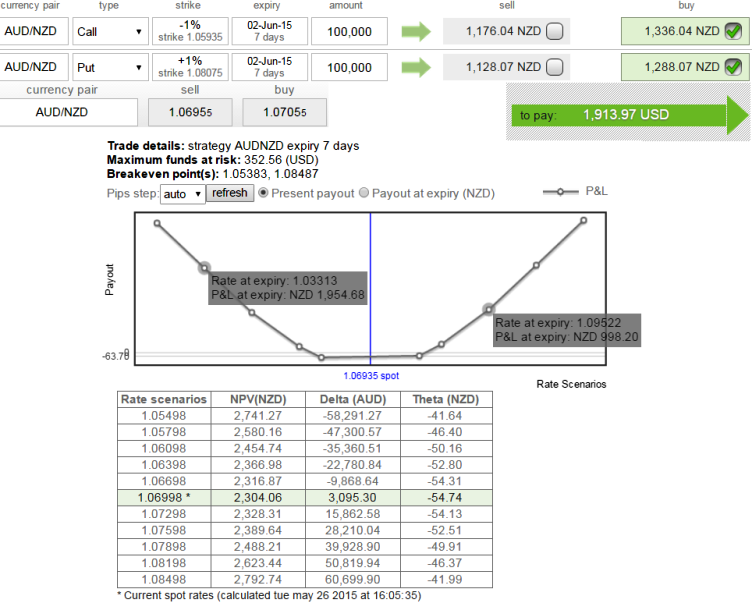

As we advocated this strategy in our earlier post, we re-iterate by stating that Theta on this strategy signifying time decay advantage of the ITM options of this pair as shown in the diagram.

In the figure, there is no significant change in theta value even though the underlying exchange rate oscillates dramatically. (From spot 1.0705, if it moves to any extreme directions 1.055 or 1.085 then Theta is not moving accordingly)

Here, Theta was in the range of -54.17 to -54.74 when the options value at execution NZD 1336.04 on Call & NZD 1288.07 on put.

Theta has not been that sensitive to option's value to the passage of time.

For ITM call option, as time to expiry draws nearer, Theta lowers and decreases. In this case of AUD/NZD long guts, the relative change is not significant.

The long guts is a neutral strategy in options trading that involve the simultaneous buying of an ITM call option and an ITM put option of the same underlying currency and expiration date.

This is an unlimited profit, limited risk strategy that is taken when the options trader thinks that the underlying stock will experience significant volatility in the near term.

These long guts are a debit spread as a net debit is taken to enter the trade.

Large gains for the long guts strategy is attained when the underlying currency price makes a very strong move either upwards or downwards at expiration.

The move in the underlying currency price must be strong enough such that either the long call or the long put rise enough in value to offset the loss incurred by the other option expiring worthless.

Trade on Long Guts of AUD/NZD as Theta (Θ) on time benefits

Tuesday, May 26, 2015 11:16 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?