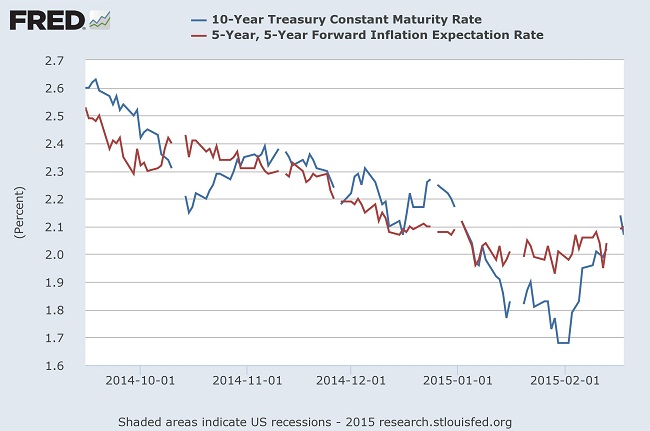

The chart is of benchmark US 10 year treasury yield and inflation expectation measured by 5 year forward rates.

Notable points -

- Volatility increasing in all markets, including treasuries.

- Inflation expectation is stabilizing after falling since early 2014.

- Inflation expectation still might deteriorate if oil price fall further.

Analogy is -

- Rise in the short term rate will boost the longer end of the curve through term premium, should the Federal Reserve hike rate early enough.

- Long end treasuries will react more to any fastening of Federal Reserve rate hike path than to actual inflation expectation as it remain clouded by lower energy price.

We expect the dollar to be bullish against major counterparts should the term premium start firming.

Dollar index is trading at 94.7 up 0.32% for the day.

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?