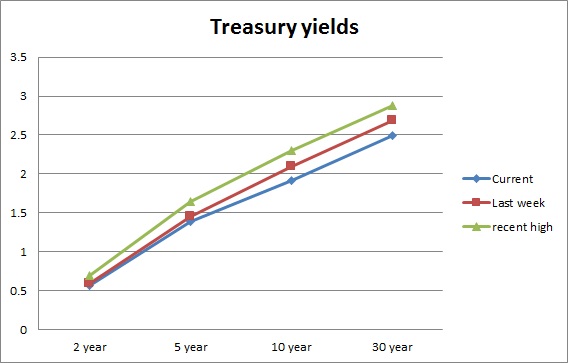

US treasuries continued their rise as NFP report overwhelms investors and economists. Last week's payroll number increased by 295,000. Hiring was seen across sectors, only mining and petroleum accounted for job losses.

- Treasuries are now almost predicting a rate hike in June, in line with the commentaries by FED official.

- As of now, focus is on first rate hike date, so once the short end of the curve pricing a hike in June; it may continue to drift until the FED acts on its commitment.

- Most probable date for FED to drop the patient word somewhere in April. Earlier or later would be market moving.

Probable scenarios -

- FED hikes in June and move the range to 0.25%. High probability. Despite immediate market reaction, major volatility will arrive over the press conference as market will search for future clues.

- FED does not hike in June. Disappointments will be high over the future funds rates. Longer end yields would react more to the downside and dollar might end its magnificent ride.

Once priced in treasuries might continue to drift sideways waiting for the disappearance of the patient word from FED guidance. Dollar might continue to outperform until the event. Dollar index is currently trading at 97.5, down 0.2% for the day.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?