A Trump administration will present challenges to both Asian currencies and bonds. Trump’s pro-US growth and pro-fiscal stimulus economic policies coupled with a protectionist stance on global trade is a major setback particularly for trade-reliant countries like Singapore, Malaysia, Thailand, Taiwan and South Korea. Countries like Indonesia and India which are more domestically driven economies are likely to be less impacted.

Trump’s election proposals, which are pro-US growth supported by fiscal spending, will ultimately underpin the US economy, further boosting employment and wage growth. With U.S. labour market already close to full employment, it will push US inflation higher, meeting the US Federal Reserve’s dual mandate sooner than expected. Market pricing of a Fed rate hike at December meeting has risen to 80 percent after the elections and 36.8 percent of another 25bp hike by December 2017).

"We think there is a significant under-pricing of rate hikes beyond 2016. Our current house-view is for two 25bp hikes in 2017," said ANZ in a report to clients.

Asian region witnessed strong capital inflows of around USD39bn in the first nine months of the year on the back of the easy monetary policies of global central banks. The large portfolio flows into the region this year is at risk of a reversal as further monetary accommodation is now in doubt.

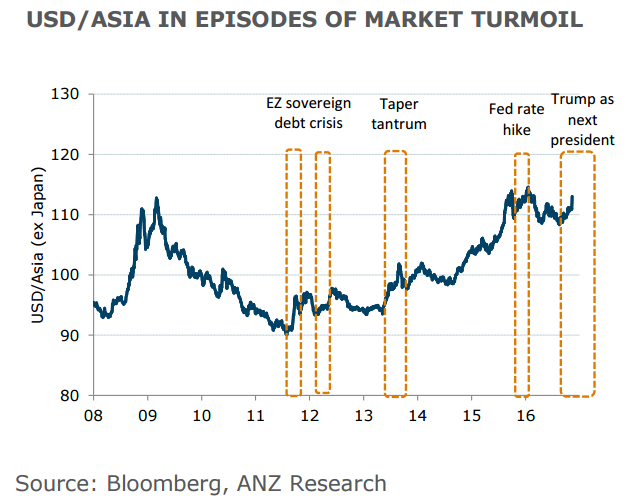

KRW and MYR are risk-sensitive currencies which are most vulnerable. RMB, together with the SGD is likely to lose further ground in trade-weighted terms. Asian bonds are also to come under pressure, extending the recent sell-off. Unlike in the previous episodes when Asian currencies rebounded swiftly after a short period of sell-off, the fall in Asian currencies this time round will most likely extend through 2017.

FxWirePro's Hourly Currency Strength Index was showing USD strength at +81.4924 at around 1245 GMT.

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility