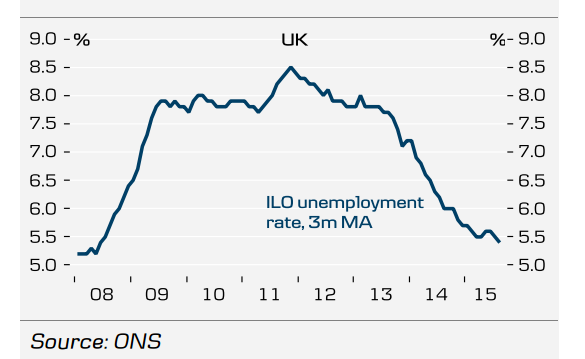

The UK labour market report released today was somewhat mixed. On the one hand the unemployment rate (3M average) declined to 5.4% in August from 5.5% in July (consensus: 5.5%). On the other hand wage growth, in terms of average weekly earnings excluding bonuses (3M), slowed to 2.8% y/y in August from 2.9% y/y (consensus: 3.0% y/y). Wage growth slowed both in the private and public sector.

Despite the slightly slower wage growth, real wage growth is still high as inflation continues to be very low, which supports private consumption and, thus, growth in the UK. The fall in the unemployment rate (3M average) was due to a fall in the single month unemployment rate from 5.4% in July to 5.3% in August. The number of unemployed persons declined by 79,000 in the past three months as employment increased by 140,000. The labour force expanded by 61,000.

Employment growth slowed in Q2 but as expected this was only temporary and the labour market has continued to improve in Q3. The unemployment rate is more or less back to 'normal' as the Bank of England (BoE) estimates that the medium-term equilibrium unemployment rate is around 5.5%.

As the economic upturn in the UK remains on track, the labour market is expected to continue to tighten going forward, although probably not at the same pace as in 2013-2014. The slower wage growth is due more to the volatility of the series than a sign of weakness.

"We still see an underlying upward trend in wage growth and think wage growth will accelerate going forward as the labour market continues to tighten", notes Danske Bank.

UK August Labour Report: Mixed messages

Thursday, October 15, 2015 12:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed