Today fourth quarter GDP to be released from UK at 8:30 GMT.

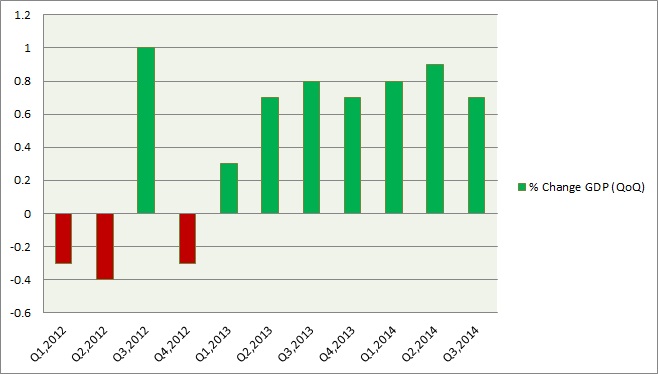

- As per latest data showed in the chart, UK growth remained strong so far. UK economy grew 2.6% in the last quarter whereas the average growth in G7 economies and OECD remain below 2%. Quarterly growth was 0.7%.

- However weaker economic dockets faded away the rate hike bets by Bank of England (BOE) that resulted in pound dropping from 1.7 by mid of 2014 to current 1.47 against dollar. Rate hike bets moved higher for FED.

- Moreover weaker inflation dockets continue to weigh on Pound. Latest release showed core CPI grew just 1.2% YoY, down from previous 1.4%.

- Recent talks suggest that debates might be heating up inside BOE over policy move. BOE governor Mark carney and several MPC members have reiterated that rate hike would be the most probable next move, whereas chief economist Mr. Haldane raised possibilities of a rate cut.

Analogy -

- Market is expecting slight slowdown in growth. 0.5% QoQ and 2.7% YoY.

- Pound has recently been showing strength against other majors namely Euro and Yen and might strengthen further should the GDP surprise on upside.

- Pound is currently trading at 1.476 against the dollar and moving closer to support area of 1.465. However any upside against dollar could be limited even with better economic release.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand