The market expects the UK rates to be 1.15% at the end of 2016 and 1.6% at the end of 2017 with a terminal rate of just 1.65% being expected. There is a clear risk that rates rise more than this:

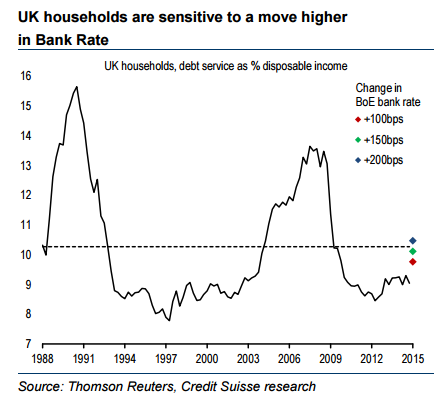

1) Around half of the stock of mortgages are now fixed rate (up from less than 30% three years ago); indeed 85% of new mortgages are fixed. Moreover, the back book of mortgages has a 50bp higher rate than the front book. Thus, the interest rate sensitivity of the UK consumer has nearly halved. A 2% rise in rates over two years will take around 1 percentage point off disposable income.

2) As we approach 2018, fiscal policy will be eased as we move into a conservative leadership election.

3) 10% on sterling takes about 1% off inflation. The rate of sterling strength accelerates from here (currently, in year-on-year terms, sterling is up 5%).

For these reasons, it is believed that the gilt yield could end up rising more than the market expects.

"Credit Suisse rates strategists forecast that gilt yields will rise to 2.3% by the end of Q1 2016," notes Credit Suisse.

UK: MPC may end up raising rates by more than expected

Wednesday, July 29, 2015 1:53 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed