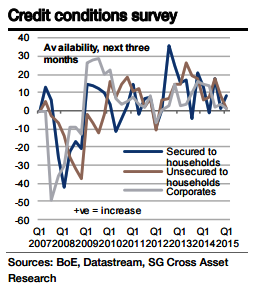

For the coming three months, i.e. Q2, a small pickup is expected in UK credit availability and in demand. The hard data up to May corroborate that forecast increase in demand but it is still not strong.

The Q1 Bank of England Credit Conditions survey reported that mortgage availability was broadly unchanged but that mortgage demand decreased significantly. This was somewhatsurprising, given that consumer confidence was strong, real incomes were rising and mortgage rates falling.

The broad picture from the survey was that overall credit availability was only expanding gently in 2014. This is puzzling since the banking sector is healing in the sense of becoming better capitalized and its bad loan experience is improving.

"In the Q2 survey banks are expected to indicate that overall availability will again increase only slightly", says Societe Generale.

UK Q2 credit conditions hardly changing

Monday, July 13, 2015 5:54 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX