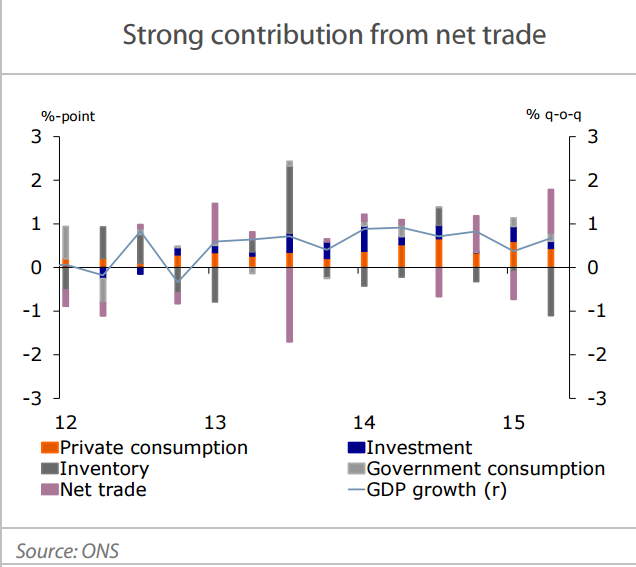

The second estimate of GDP in 2015Q2 confirmed that the British economy expanded by 0.7% q-o-q in the second quarter of 2015. All components, except inventory formation, contributed positively to economic growth. Private consumption increased by 0.7% q-o-q and investment by 0.9%. The latter was mainly driven by business investments, which increased by 2.9% q-o-q. Housing investment, on the other hand, shrunk by 3.5%. But most notable was the 3.9% q-o-q increase of exports. Since imports increased only 0.6% q-o-q, net trade contributed 1% to economic growth. However, this support is not expected to last, since British firms will likely suffer from the strong pound sterling compared to the euro, which will make British products relatively more expensive for the eurozone.

Furthermore, lower productivity growth over the last couple of years -compared to competitors in the United States and Europe- might hurt export performance going forward. On average, nominal wages increased by 2% over the last year, while labour productivity all but stagnated in 2014 (+0.1%). A strong decrease in export orders for July, according to the CBI survey, support the view of a slowdown in export growth in 2016.

UK economic growth in Q2 widely supported

Wednesday, September 2, 2015 10:48 PM UTC

Editor's Picks

- Market Data

Most Popular

Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure

Australian Dollar Rallies on Hawkish RBA Outlook; Yen Slips as BOJ Faces Political Pressure  Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom

Bank of Korea Holds Interest Rate at 2.50% as Growth Outlook Improves Amid AI Chip Boom  Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears

Oil Prices Surge 13% as U.S.-Israel Strikes on Iran Spark Supply Fears  MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains

MOEX Russia Index Hits 3-Month High as Energy Stocks Lead Gains  USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports

USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports  Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock

Strait of Hormuz LNG Crisis Triggers Global Energy Market Shock  Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA

Stock Market Movers: Dell, Block, Duolingo, Zscaler, CoreWeave, Autodesk, Rocket, MARA  Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit

Germany and China Reaffirm Open Trade and Strategic Partnership in Landmark Beijing Visit  Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens

Japan Manufacturing PMI Jumps to Four-Year High as Global Demand Strengthens  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed