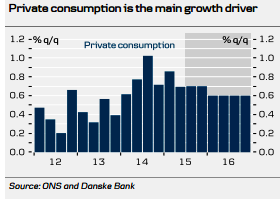

The economic upturn in the UK is on track and the UK is expected to expand slightly above trend in the coming quarters. Growth is expected to be driven mainly by domestic demand and in particular by private consumption as the outlook for private consumption remains solid. Private consumption is supported by a combination of higher employment, positive real wage growth for the first time since 2009 and high consumer confidence.

"While private consumption is likely to grow, zero growth should be seen in government consumption in the coming quarters. Government consumption has surprised on the upside so far this year and grew by 0.9% q/q in both Q1 and Q2. The government's fiscal consolidation plans mean that we see limited room for growth in government consumption going forward", says Danske Bank.

The risk is that the speed of adjustment will be faster than currently anticipated by the market and thus will pull down growth. That said, it seems appropriate totighten fiscal policy as the UK economy is expanding at a solid pace even without expansionary fiscal policy. Also, monetary policy is still extremely accommodative and will probably only be tightened very gradually.

"Investments are expected to continue to grow at a solid pace as more private firms are close to their capacity limits and labour has become increasingly expensive. Downside risks to our forecast are the fiscal consolidation plans and the upcoming EU in/out referendum. The fiscal consolidation plans may weigh on total investments through lower government investments", anticipates Danske Bank.

The upcoming EU in/out referendum raises the issue that firms may be reluctant to invest: the possibility of a vote to 'leave the EU' means that the future economic environment for British firms is uncertain. The outlook for exports remains subdued due to a combination of slow growth in the rest of Europe (the UK's biggest export partner) and the strong sterling.

"Net exports are expected to pull GDP growth down by 0.3pp in 2016. Inventories have declined in recent quarters and we expect them to increase slightly in the coming quarters thereby contributing to growth", added Danske Bank.

UK growth to be driven by domestic demand

Friday, September 4, 2015 5:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022