Today, some of the measures of inflation in UK improved but levels of inflation that can be considered as normal, still remains quite a far away.

Key highlights -

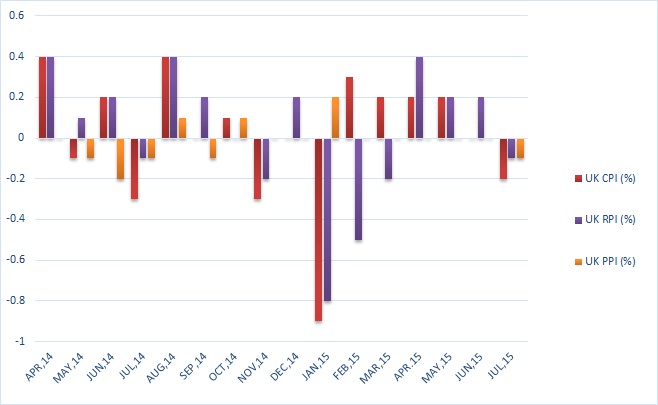

- Producer price index grew +0.3% in July y/y. Producer price index grew marginally for core materials at 0.1% m/m. It is still down by -1.6% from a year ago.

- House prices grew in July, however at slower pace than expected, grew 5.7% in July from a year ago. Much lower than February's 8.4% growth.

- Retail price index dropped below zero level, at -0.1% m/m but grew 1% y/y in July.

- Consumer price index dropped by -0.2% m/m but Core CPI rose sharply at 1.2% from a year ago, compared to prior 0.8%.

Data from UK points at recovery in inflation, however doubts remain over whether it can be sustained or not.

- Bank of England (BOE) despite shrugging with lower inflation, has indicated that rapid growth in private sector demands policy normalization and rate hike might begin as early as next year.

Pound is sharply up today, however struggling to break free of its range high around 1.568-1.572. Pound is currently trading at 1.569 against Dollar.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand