Today inflation reading will be published from UK at 9:30 GMT. Data set includes Consumer Price index (CPI), producer price index (PPI), and retail price index.

- Inflation readings that faltered recently are the top most indicator watched by Bank of England (BOE) which estimated 2015 will be the year for first rate hike in UK. Current rate stands at 0.50%.

Past trends -

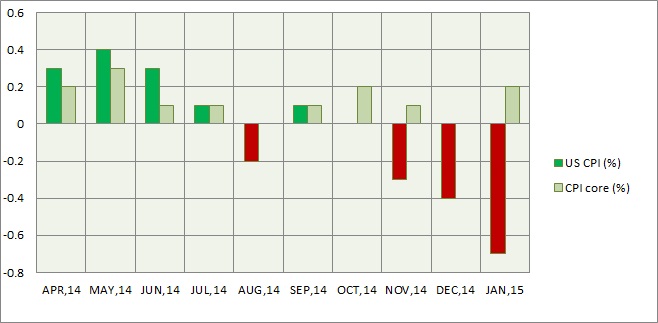

- CPI has been hovering close to zero percent. In January reading was deep in negative territory, fell by -0.9% mom. In last 10 months only 40% of the readings were above zero.

- PPI has been consistently negative throughout last year. Last positive reading was in April 2014.

- RPI last year mostly remained in positive territory however in later half of the year and especially January saw sharp decline. In January 2015 RPI fell by -0.8%.

Expectation today -

- CPI is expected to grow at 0.3% mom, in line with positive CPI in Euro zone.

- PPI is expected to grow at 0.1%.

- RPI is expected to turn sharply by 0.5%.

Market impact -

- Pound would be badly hurt should inflation readings falter. Major focus will be on CPI.

- However an exceptional increase might fuel rate hike bets by BOE.

Since dollar is weak across board, other pound crosses namely EUR/GBP, GBP/NZD hold more lucrative opportunities. Euro in short term might gain against pound further. Pound is trading at 1.495 against dollar.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary