Today's PMI report showed that UK services sector started the quarter on weaker footing.

UK GDP growth has beat pre-crisis high relying on services sector growth. Growth in manufacturing and construction still remains well below their pre-crisis high. Naturally a slowdown in UK's dominant services sector likely to weigh on overall growth.

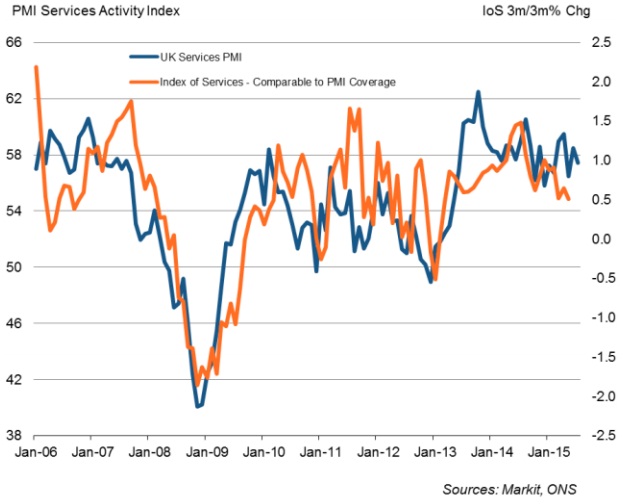

Today UK services sector PMI slowed to 57.4 in July from 58.5 in June.

Moreover yesterday report from Markit showed slowdown in construction sector. In July, only manufacturing PMI, led by mining grew marginally.

UK services PMI in spite of slowdown remains at 57.4, well above 50 mark which signal expansion.

However looking at much larger trend it can be pointed out that pace of growth has been steadily slowing from its peak at 63 in 2013.

Today's report from Markit pointed out that -

- New business growth strengthened but longer term outlook has eased to five month low.

- Employment still rose but at weakest pace since March 2014.

While Pound remains well bid after comments from Mr. Carney last month over rate hike, weaker than expected quarter might push expectations bit further.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary