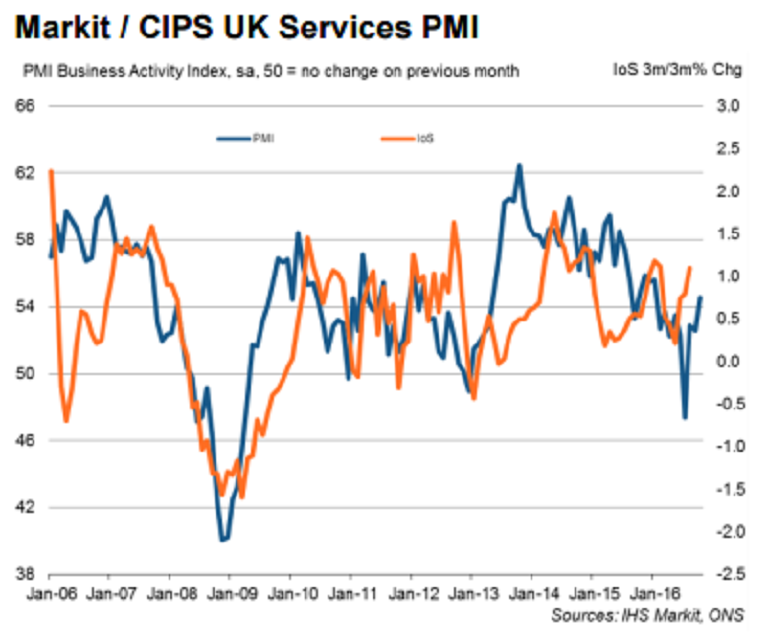

Growth in the United Kingdom’s service sector accelerated during the month of October, beating market expectations; however, it remained well above the 50-point no-change threshold for the third consecutive month in a row, indicating a continued recovery in growth following a contraction in July linked to the EU referendum.

U.K.’s Markit/CIPS UK Services Purchasing Managers Index (PMI) rose to 54.5 from 52.6 in September, marking its highest level since January and topping all forecasts in a Reuters poll of economists that pointed to a slight fall to 52.4. Moreover, the country’s Services Business Activity Index rose to 54.5, from 52.6, signalling the fastest expansion since January.

The survey also showed that a weak pound drove a marked intensification of cost pressures at service providers in October. Input price inflation surged to the highest since March 2011, with a survey-record month-on-month acceleration. Business expectations continued to recover from July’s near seven-and-a-half year low in October.

Further, service providers in the UK continued to add to their workforces in October. Employment increased for the third month running, albeit with the rate of job creation remaining well below the marked rates achieved in 2014 and 2015.

Meanwhile, concerns over the EU referendum result showed some signs of dissipating as respondents commented on a refocus on opportunities and ramped up marketing and sales promotions.

"Concerns over the EU referendum result showed some signs of dissipating as respondents commented on a refocus on opportunities and ramped up marketing and sales promotions," said Chris Williamson, Chief Business Economist, IHS Markit.

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals