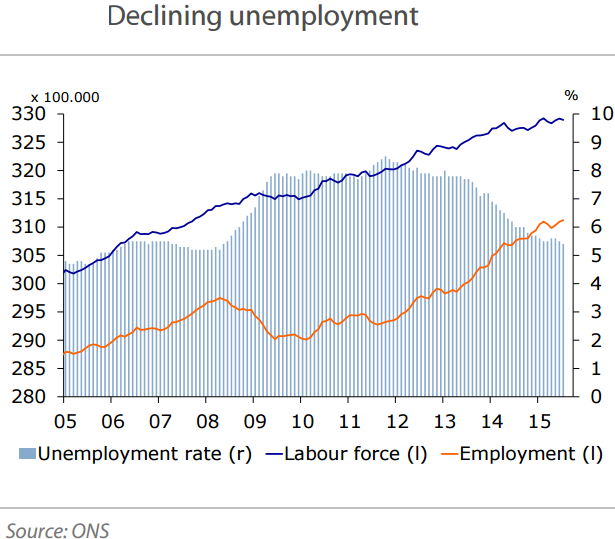

Several signs point to slightly weaker labour market developments, although the overall tone remains relatively robust. In July, the unemployment rate declined by 0.1%-point for a second consecutive month and is now standing at 5.4%, a new post-crisis low and just 0.3%- point higher than the pre-crisis level.

The decline in the unemployment rate was due to a 0.1%-point increase in employment and a 22K decline in the labour force. However, claimant count data suggest unemployment rose in both August and September. This corresponds with a decline in vacancies in August and a 0.2% m-o-m decline in real average weekly earnings (excl. bonuses).

On a yearly basis, real wage growth still rose a robust 3.1% in August. Going forward, it is believed that the employment growth will still be positive, albeit possibly on a slightly weaker path as much slack has already been eroded.

UK unemployment decreased again

Tuesday, November 3, 2015 11:26 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022