Following the latest selling in the United States Treasuries pushed the benchmark 10-year yields to 2.64 percent, highest since September 2014. This was majorly driven by the Federal Reserve’s increased inflation expectations and labour market tightening.

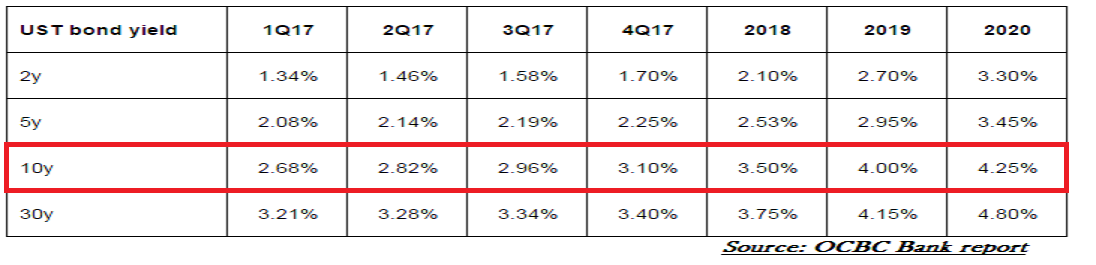

The benchmark 10-year Treasury yields likely to break 3 percent mark and rising to 3.10 percent in the last quarter of 2017, said OCBC Bank in its recent report.

The Federal Open Market Committee increased the fed funds rate to a 0.50-0.75 percent range, as widely expected on later Wednesday. The statement noted that information received since the November meeting indicates that the labour market has continued to strengthen and that economic activity has been expanding at a moderate pace since mid-year.

Also, the new projections showed that the central bankers expect three quarter-point rate increases in 2017, up from the two seen in the previous forecasts in September, based on median estimates.

With the FOMC delivering the widely anticipated 25 basis points rate hike at its December meeting, the tone was slightly more hawkish in terms of the median dots graph, even though the economic projections were essentially little changed. Growing confidence, whether misplaced or not, about the US economy’s potential growth rate amid heightened reflationary expectations for the incoming President Trump’s fiscal boost, with attendant implications for wage-fuelled inflation, may continue to lend a bear-steepening bias in the near-term, reported OCBC Bank in its report.

This is notwithstanding our base-case scenario that the FOMC is prone to over-promise and under-deliver on interest rate hikes, as has been the case for recent years. Moreover, the FOMC remains data-dependent and susceptible to any financial market volatility that may constrain the projected normalisation trajectory, they added.

Lastly, we also foresee that next year the 10-year yields will likely break 3 percent mark, the highest level in three years if the Federal Reserve successfully increases interest rate in 2017. We also expect that the inflation numbers will be the key determinants in the New Year to support the Federal Reserve hawkish path.

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022