Today NFP report for the month of December is to be published at 13:30 GMT from US.

What is NFP report?

- NFP or non-farm payroll report is the monthly statistics on labor condition in the US released by US department of labor statistics. The report comprises goods, construction and manufacturing sector companies.

- This report influences the financial markets deeply across asset class.

Key highlights –

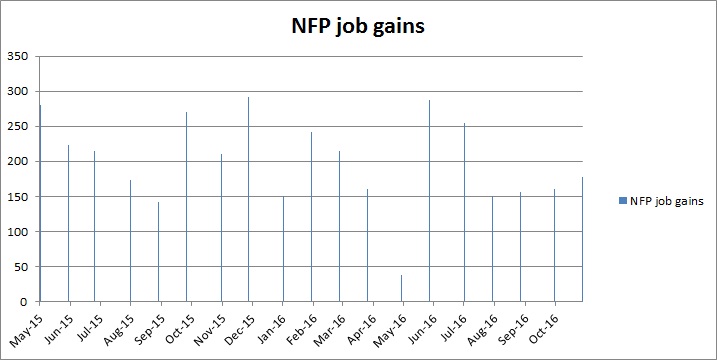

- Last month’s report was a strong one with 178,000 gains.

- Change in private payroll has been 156,000 last month. Today expected 170,000.

- Total payrolls are expected at 175,000.

- Most vital component is wage growth, which last year started showing some strength. Today it is expected to rise by 0.3 percent on monthly basis and 2.8 percent annually.

- Labor force participation rate still subdued at 62.7 percent.

- Unemployment rate is expected to rise by 0.1 percent to 4.7 percent.

- Underemployment rate is expected to fall further from current 9.3 percent

Impact –

- Volatility is sure to be on the card, post release.

- Any number above 200,000 would be considered as very good and investors will further push the odds of a rate hike for December.

- While number below 150,000 will pose serious doubts over the strength of the labor market if wage growth drops too. In such a case, there could be a big slide in the dollar, which is already under pressure over the yuan’s rise.

Better than expected wage growth would be key to Dollar’s strength. Any wage growth above 2.8 percent will bring the focus on faster rate hikes. Better payroll can also boost sentiment for equities.

The dollar index is currently trading at 101.66, up 0.26 percent for the day so far.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility