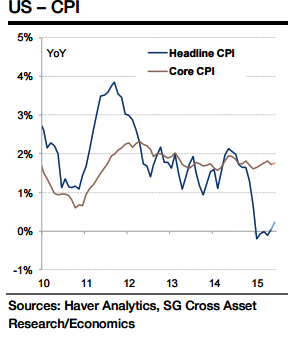

US headline inflation has undoubtedly bottomed. After a 0.4% m/m increase reported for May, a similar gain is expected in June. This time, however, the gain is expected to be more broadbased and not just driven by energy. Gasoline prices are estimated to be rose by 4.9% m/m in seasonally adjusted terms, boosting the headline by about 0.2%.

"Food prices, which have been falling since January, are also likely to reverse and we project a 0.15% m/m gain in this component of the CPI basket. Most importantly, core inflation is likely to return to a trend-like 0.2% m/m pace after a 0.1% print in May", says Societe Generale.

The prior month's weakness was concentrated in US' used vehicle prices and in lodging, and this is not expected to be sustained. The yoy inflation rate might finally move to the positive territory for the first time since December.

"Core inflation should rise from 1.7% to 1.8%, meeting one of the Fed's criteria for a lift-off in rates", added Societe Generale.