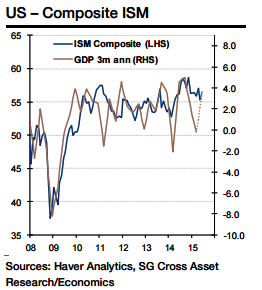

The US manufacturing ISM report released last week suggests that the factory sector is rebounding from its earlier weakness. The non-manufacturing ISM index has fared muchbetter all along and is expected to remain at a level consistent with strong GDP growth.

A 1.2 point increase in June to 56.9 which would reverse about 50% of May's decline and keep the composite well within its recent ranges, says Societe Generale. The outperformance of the service sector can be explained by two factors minimal sensitivity to the dollar's strength and more limited spillover from the weakness in oil & gas investments.

These factors have been weighing on manufacturing activity but should begin to dissipate in the coming months. Weak consumer demand was also a factor supressing demand for both goods and services in Q1, but this is now reversing. 56.9 forecast for the non-manufacturing ISM would put the composite of the two surveys at 56.5. This is consistent with GDP growth of 3.5%, close to 3.3% forecast for second quarter growth, says Societe Generale.

US Non-manufacturing ISM to rise modestly

Monday, July 6, 2015 3:47 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed