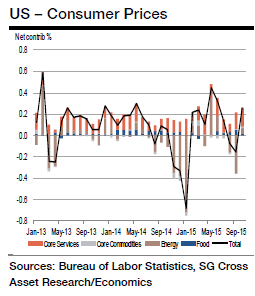

In the United States, the consumer price data for October is due today. Higher retail price and likely increase in core goods and services costs may cause the headline CPI to increase in the reference period. The motor fuel costs are likely to rise by 1.1%, which was 8.9% in Septeber, says Societe Generale.

The price of electricity, esidential natural gas, and heating oil is likely to fall down, therby, the CPI energy likely to be weak.

"Our projections, if accurate, would place the CPI 0.2% above the figure recorded in October 2014. The year-to-year growth of the core subindex, meanwhile, is expected to remain at 1.9%", estimates Societe Generale.

U.S. October headline CPI likely increased by 0.2%

Tuesday, November 17, 2015 5:16 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022