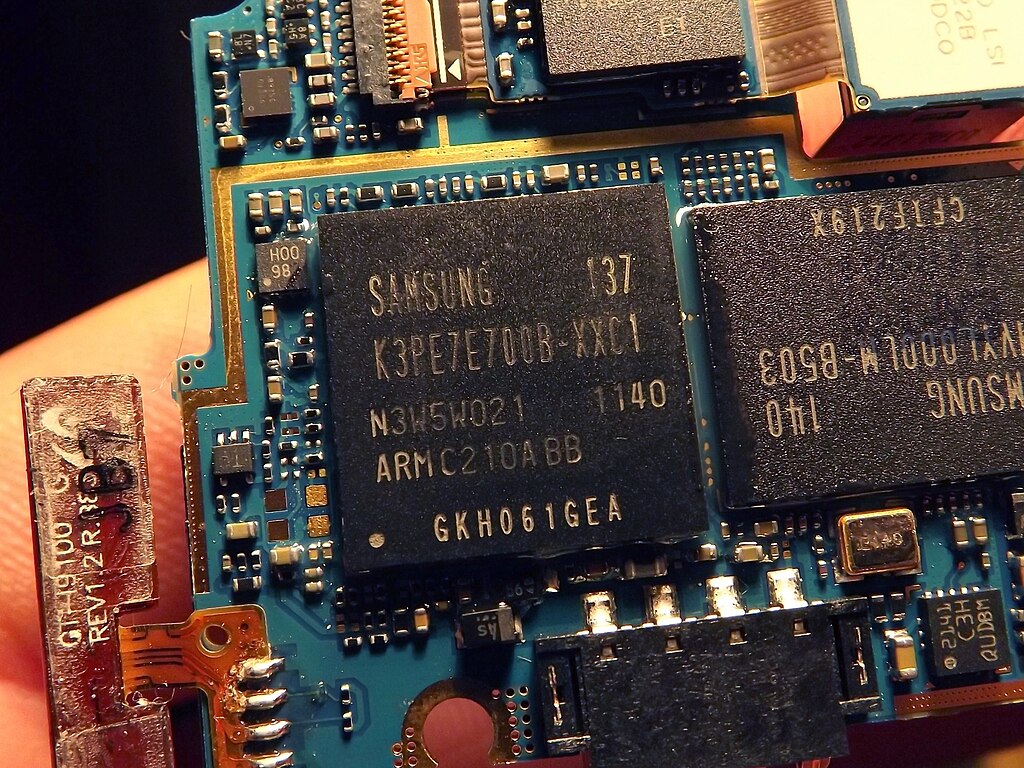

The United States is considering new rules that would require Samsung Electronics and SK Hynix to seek yearly approvals for exporting chipmaking equipment to their factories in China, according to a Bloomberg report. The proposal marks a shift from the indefinite authorizations the companies previously held under the Biden administration, signaling tighter oversight of semiconductor supply chains linked to China.

Sources cited by Bloomberg revealed that U.S. Commerce Department officials recently introduced a “site license” concept during talks with South Korean counterparts. This approach would replace the existing open-ended approvals with an annual review process, giving Washington greater control over advanced chipmaking tools supplied to facilities in China.

The move comes amid heightened U.S.-China tensions over technology access and efforts to restrict China’s ability to advance in semiconductor production. By requiring yearly checks, U.S. authorities aim to balance national security concerns with the global chip industry’s need for stability. Samsung and SK Hynix, two of the world’s leading memory chipmakers, have extensive investments in China, making them key stakeholders in the evolving policy.

While the report highlights growing scrutiny, it also underscores ongoing negotiations between Washington and Seoul. South Korea remains a crucial ally in U.S. semiconductor strategy, and any policy shift could affect global supply chains. As the semiconductor industry faces rising demand and geopolitical challenges, the proposed changes signal that U.S. export controls will continue to play a central role in shaping the future of chip manufacturing.

Reuters has not independently verified Bloomberg’s report, but the development highlights the uncertainty chipmakers face as global governments tighten regulations around critical technologies.

Trump to Announce New Federal Reserve Chair Pick as Powell Replacement Looms

Trump to Announce New Federal Reserve Chair Pick as Powell Replacement Looms  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure

Oracle Plans $45–$50 Billion Funding Push in 2026 to Expand Cloud and AI Infrastructure  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations

Panama Supreme Court Voids Hong Kong Firm’s Panama Canal Port Contracts Over Constitutional Violations  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants

Federal Judge Blocks Trump Administration Move to End TPS for Haitian Immigrants  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade

Trump Extends AGOA Trade Program for Africa Through 2026, Supporting Jobs and U.S.-Africa Trade