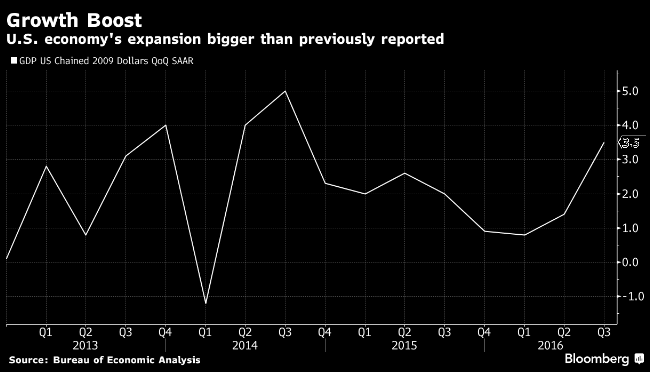

The gross domestic product (GDP) of the United States was revised higher during the third quarter of this year, following upbeat performance in personal consumption, amid healthy growth in the country’s services sector as well. Despite a rise in the number of unemployment benefits, which clouded Federal Reserve Chair Janet Yellen’s hawkish tone, solid growth performance offset the same, adding to hopes of a sustained recovery in the world’s largest economy.

The third estimate of Q3 GDP was revised higher to 3.5 percent from 3.2 percent in the second estimate, a touch stronger than consensus of 3.3 percent, data released by the Commerce Department’s showed Thursday.

The main sources of the upward revision were personal consumption of services, nonresidential structures investment, and government consumption. Services consumption is now reported to have grown by 2.7 percent q/q saar, up from 2.5 percent in the second estimate and 2.1 percent in the advance release.

Durables consumption rose 11.6 percent and overall private goods consumption held steady at 3.5 percent on the quarter. At 3.0 percent, personal consumption slowed less noticeably from the solid 4.3 percent growth rate recorded in the second quarter than initial Bureau of Economic Analysis (BEA) estimates indicated.

Nonresidential structures investment rose 12.0 percent, up from 10.1 percent in the second estimate, pushing fixed investment into positive territory to 0.1 percent versus the small contraction as previously reported. Finally, government consumption is now reported to have grown 0.8 percent q/q saar, up from 0.2 percent, on a smaller contraction in state and local spending to -0.2 percent, from -1.1 percent.

Meanwhile, the dollar index traded at 102.98, down -0.11 percent, while at 5:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at -8.36 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022