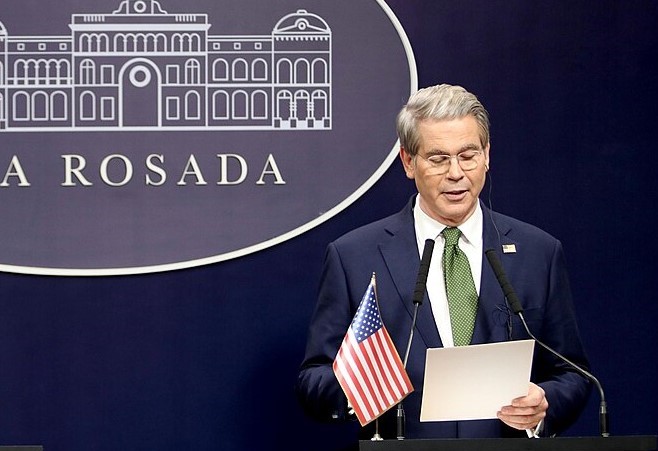

The United States may lift additional sanctions on Venezuela as early as next week to facilitate oil sales and economic stabilization, according to comments by U.S. Treasury Secretary Scott Bessent in an interview with Reuters. The move is part of the Trump administration’s broader strategy to revive Venezuela’s economy, stabilize the country, and encourage the return of U.S. oil producers following the recent arrest of Venezuelan leader Nicolas Maduro on drug trafficking charges.

Bessent said the Treasury Department is actively reviewing sanctions related to Venezuelan oil, particularly those affecting crude stored on ships. The goal is to allow oil sale proceeds to be repatriated back to Venezuela to fund government operations, security services, and public needs. While Bessent did not specify which sanctions could be lifted, he emphasized that changes could come quickly.

A major focus of the U.S. effort is unlocking Venezuela’s frozen International Monetary Fund Special Drawing Rights. Venezuela holds roughly 3.59 billion SDRs, valued at nearly $5 billion, which it has been unable to access due to sanctions. Bessent said the U.S. Treasury would be willing to convert these SDRs into U.S. dollars to help rebuild Venezuela’s economy. He is also scheduled to meet next week with the heads of the IMF and World Bank to discuss their potential re-engagement with the country.

U.S. sanctions have long prevented international banks and creditors from dealing with Venezuela, complicating a widely anticipated $150 billion debt restructuring seen as critical for attracting private investment. To protect future revenues, President Donald Trump signed an executive order blocking courts or creditors from seizing Venezuelan oil revenue held in U.S. Treasury accounts.

Bessent expressed confidence that smaller private oil companies would move rapidly back into Venezuela, while Chevron is expected to expand its long-standing presence. He also suggested the U.S. Export-Import Bank could help guarantee financing for Venezuela’s oil sector, potentially accelerating recovery and foreign investment.

Gold Prices Surge for Fourth Day as Middle East Tensions and Strong U.S. Dollar Shape Market

Gold Prices Surge for Fourth Day as Middle East Tensions and Strong U.S. Dollar Shape Market  Suspected Iranian Drone Hits CIA Station at U.S. Embassy in Riyadh Amid Rising Middle East Tensions

Suspected Iranian Drone Hits CIA Station at U.S. Embassy in Riyadh Amid Rising Middle East Tensions  Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target

Bank of Japan Signals Further Interest Rate Hikes as Inflation Trends Toward 2% Target  Trump Says U.S.-UK Relationship Has Deteriorated After Starmer Hesitates on Iran Strikes

Trump Says U.S.-UK Relationship Has Deteriorated After Starmer Hesitates on Iran Strikes  Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology

Trump Orders Federal Agencies to Halt Use of Anthropic AI Technology  Trump to Attend White House Correspondents’ Dinner 2026, Ending Long Boycott

Trump to Attend White House Correspondents’ Dinner 2026, Ending Long Boycott  Middle East Air War Triggers Massive Flight Cancellations and Global Airline Disruptions

Middle East Air War Triggers Massive Flight Cancellations and Global Airline Disruptions  FAA Suspends Flights Near Fort Hancock, Texas After Suspected Laser Anti-Drone Incident

FAA Suspends Flights Near Fort Hancock, Texas After Suspected Laser Anti-Drone Incident  FDA Warns Novo Nordisk Over Misleading Ozempic Ad Claims

FDA Warns Novo Nordisk Over Misleading Ozempic Ad Claims  U.S. Begins Charter Evacuations as Iran Conflict Disrupts Middle East Air Travel

U.S. Begins Charter Evacuations as Iran Conflict Disrupts Middle East Air Travel  Santander’s $12.2B Webster Financial Deal Faces Uncertainty Amid U.S.–Spain Trade Tensions

Santander’s $12.2B Webster Financial Deal Faces Uncertainty Amid U.S.–Spain Trade Tensions  Asian Stocks Tumble as US-Iran Conflict Escalates and Oil Prices Surge

Asian Stocks Tumble as US-Iran Conflict Escalates and Oil Prices Surge  Venezuela Amnesty Law Frees Nearly 2,200 Prisoners, Says Jorge Arreaza

Venezuela Amnesty Law Frees Nearly 2,200 Prisoners, Says Jorge Arreaza  Japan Signals Possible Currency Intervention as Yen Slides to 157.3 Amid Middle East Tensions

Japan Signals Possible Currency Intervention as Yen Slides to 157.3 Amid Middle East Tensions  KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking

KOSPI Plunges Over 8% as U.S.-Iran War Sparks Global Risk Aversion and Profit-Taking  USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports

USITC to Review Impact of Revoking China’s PNTR Status, Potentially Raising Tariffs on Chinese Imports  U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns

U.S. Stocks Fall as Middle East Conflict Fuels Inflation and Oil Price Concerns