FOMC committee characterized household spending and business investment as increasing "at solid rates in recent months," noting also that "job gains slowed" and net exports remain soft.

The advance estimate of Q3 GDP confirmed this view, with private consumption rising by 3.2% q/q saar and final sales to domestic purchasers (GDP less trade and inventories) growing by 2.9%.

"Both rates are consistent with the view that domestic activity is unlikely to be dampened by external weakness. Net trade, which had been tracking as a substantial drag on growth until the sharp narrowing of the goods trade balance in September, was neutral on activity", says Barclays.

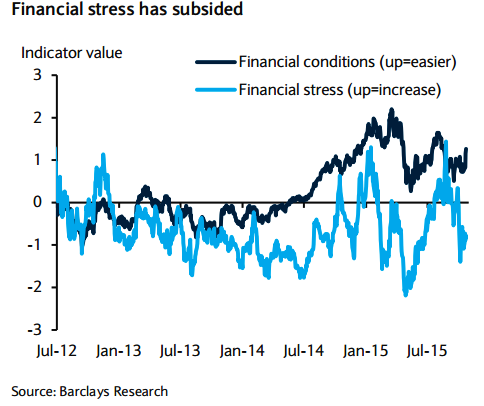

Slower inventory accumulation, which is seen as reflecting the moderation in manufacturing production, took 1.4pp off growth. In addition to solid domestic activity, the committee was likely comforted by the sharp reduction in financial market stress.

"Less financial stress is one factor in the outlook for a modest rebound in October employment growth", added Barclays.

US domestic activity and less financial stress keep Fed thinking December

Monday, November 2, 2015 5:21 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022