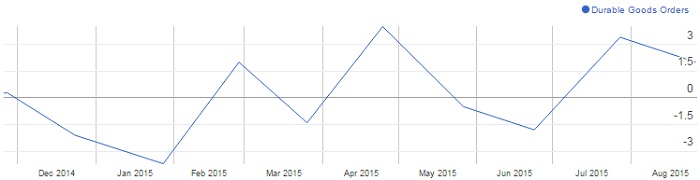

US durable goods orders, despite its own volatility provided glimpse of hope against assumption of global economic slowdown and US economy may not be vulnerable to slowdown in China.

A pickup in growth in World's largest economy will certainly provide hopes when the second largest China is expected to slow down further. Though it is likely to boost overall optimism, it may not be as much as good news for emerging economies who have greater exposure to China than US.

- Goods orders climbed 2% in July from June, beating economists' expectation of 0.4% decline and stripping the airline orders, it jumped 0.6%, again beating the forecast of 0.3%.

Despite its notorious volatility it is of high importance as it's taken as a barometer for business investment and any better data before FED meeting in September, likely to boost rate hike bets, which has declined sharply over the past couple of days.

August data will be of much more prominence since it would provide, how businesses react over current turmoil.

AI is already creeping into election campaigns. NZ’s rules aren’t ready

AI is already creeping into election campaigns. NZ’s rules aren’t ready  UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth

UBS Boosts Chinese Tech and AI Stocks for 2026 as Sector Eyes Strong Growth  Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes

Failure of US-Iran talks was all-too predictable – but Trump could still have stuck with diplomacy over strikes  Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight

Booked to travel through the Middle East? Here’s why you shouldn’t cancel your flight  BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K

BTC Blasts +$3,500 to $66,300 High — ETF Inflows Spark Institutional Comeback, Bulls Target $75K  Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000

Bitcoin Defies Geopolitical Gravity: Institutional Inflows Fuel Bullish Rebound Toward USD 70,000