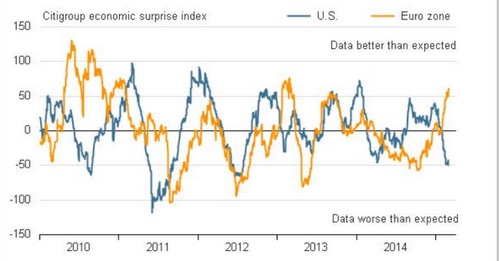

Citi group's economic surprise index has raised lot of discussions among market participants and analysts across blogs. The index tend to gauge how the actual economic activity standing in comparison to expectation.

- The indicator when compared between Europe and USA shows stark contrast between the two economic zones. While the index has sharply turned higher for Europe from latter half of 2014, US economic activities started surprising to the downside since the beginning of the year.

- In the index, gap between the two economies stand at highest since 2010. Surprise index for Europe is hovering above +50 mark whereas for US it is around -50.

This not necessarily mean US economy is going down while rising in Europe but data forecasters are too optimistic over US and too pessimistic on Eurozone. Nevertheless implications are noteworthy.

- Growth dynamics in Europe are not as bad as predicted, also evident from recent economic releases. However that might not deter European Central Bank (ECB) from continuing the easing.

- Downward revision of economic dockets and slower growth would provide Federal Reserve (FED) to delay or slowdown the rate hike as against current market expectation.

Dollar might go for deeper correction, should the upcoming data continue to surprise to the downside. Dollar index is trading at 96.55, down 0.40% today.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate