Existing home sales in the United States surged to the highest level since the global financial crisis in 2007-08, ahead of an anticipated jump in borrowing costs. Buyers, therefore, stocked up home purchases before a further rise in borrowing costs. This jump is likely to lead to a major contribution in the fourth quarter gross domestic product.

U.S. existing home sales increased 0.7 percent to an annual rate of 5.61 million units last month, the highest sales pace since February 2007. October's sales pace was revised down to 5.57 million units from the previously reported 5.60 million units, data released by the National Association of Realtors showed Wednesday.

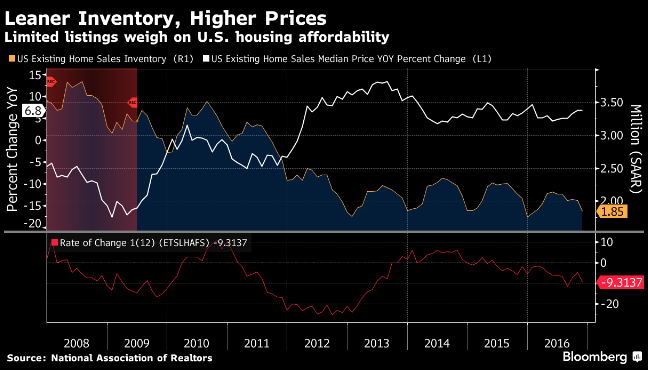

Also, sales increased 18.2 percent before seasonal adjustment from November 2015, when changes in mortgage regulations delayed closings. Median sales price climbed 6.8 percent from November 2015 to USD234,900. However, inventory of available properties dropped 9.3 percent from November 2015 to 1.85 million, marking the 18th consecutive year-over-year decline, data showed.

Further, sales picked up in two of four regions, including an 8 percent gain in the Northeast and a 1.4 percent advance in the South; single-family home sales decreased 0.4 percent to an annual rate of 4.95 million. First-time buyers accounted for 32 percent of all sales, almost steady, compared with 33 percent in the prior month.

The hike in the benchmark Fed fund rate by the Federal Reserve, chaired by Janet Yellen, on December 14, has led to further speculations of an increase in the mortgage lending rate, which will shore up housing prices in the near term.

Meanwhile, the dollar index has formed a 'hanging man' candlestick pattern at 102.95, down -0.07 percent, while at 4:00GMT, the FxWirePro's Hourly Dollar Strength Index remained neutral at 10.61 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off