The US federal government reported a monthly deficit of $64.4bn in August, modestly wider than CBO projections ($62bn) and $64bn narrower than in August 2014. A large portion of this decline, however, was due to the time shifting of payments, according to CBO analysis. Adjusting for these calendar effects, the monthly deficit would have narrowed just $4bn from the year prior. Receipts were up 8.5% y/y, driven almost entirely by growth in income and payroll taxes withheld from workers' paychecks. Spending was down 14.8% y/y on a reported basis, but up 4.3% on a CBO calendar-adjusted basis.

The growth in adjusted outlays was driven primarily by mandatory spending on entitlements. Spending on Medicaid, Medicare, and Social Security was up $10bn, while healthcare outlays related to the Affordable Care Act totaled $7bn. A $5bn decline in Department of Defense outlays helped to partially offset this spending growth.

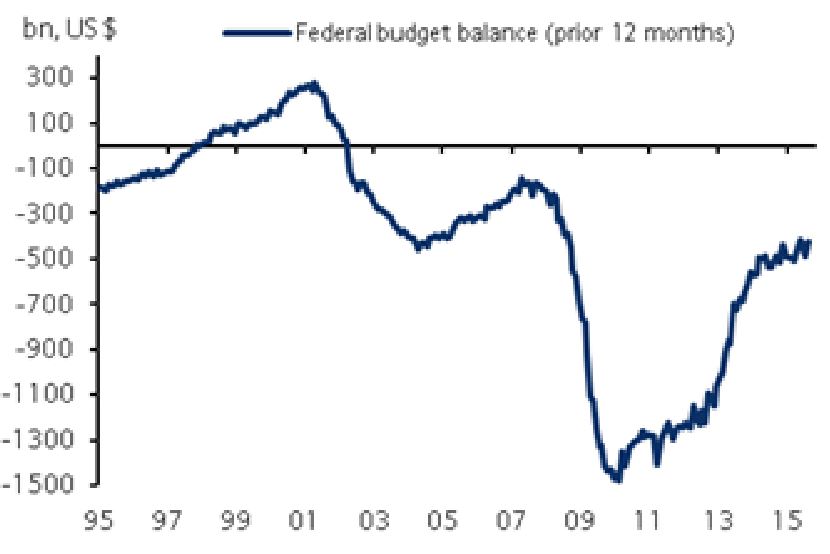

The August data bring the 12-month rolling deficit to $424.2bn, down from $488.4bn last month. Next month's data for September will mark the close of FY 2014. We look for the annual budget deficit to have totaled $425bn, in line with the CBO estimate of $426bn.

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector

U.S. Stocks Fall as Middle East Tensions Lift Oil Prices and AI Chip Export Rules Hit Tech Sector  Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks

Japan’s Rengo Unions Seek Nearly 6% Wage Increase in 2026 Labor Talks  Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty

Dollar Rally Pauses as Euro Stabilizes Amid Middle East War Uncertainty  Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets

Asian Stocks Slide as Middle East Conflict and Rising Oil Prices Shake Global Markets  Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements

Australia and Canada Strengthen Critical Minerals Partnership Through New G7 Alliance Agreements  Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply

Oil Prices Surge as Strait of Hormuz Disruption and Middle East Conflict Threaten Global Supply  Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply

Oil Prices Surge to 2025 High as U.S.-Israel Conflict With Iran Threatens Global Energy Supply  Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears

Oil Prices Surge Over 3% as Middle East Conflict Raises Supply Fears