The discrepancy between market expectations for interest rate hikes and the messaging from Federal Reserve officials continued last week. Last week's payroll report seemed to confirm market anxiety about the strength of the economy and the disinflationary global environment. Market expectations for the Fed have been pushed out to March of next year and the gap between where futures markets see rates moving after that and the Fed's own admittedly gradual course of tightening has widened further. Last week, that dovish tone in Fed expectations gave a lift to risk sentiment, with equities rallying as the week came to a close on a dovish interpretation of the minutes from the FOMC's September meeting.

In a report published by TD Bank last week, financial markets have become perhaps overly sensitive to individual data reports rather than the broader economic outlook. Nonetheless, judging by their dovish expectations for Federal Reserve policy, the consensus among investors also appears to be that the global economy will continue to worsen and that the American economy will be dragged down with it. The Federal Reserve's recognition that "global economic and financial developments may restrain economic activity" gave credence to this view. In investors' minds, this raises the probability that global events could be sufficient to dissuade a Fed that clearly wants to begin raising rates before the end of the year from doing so.

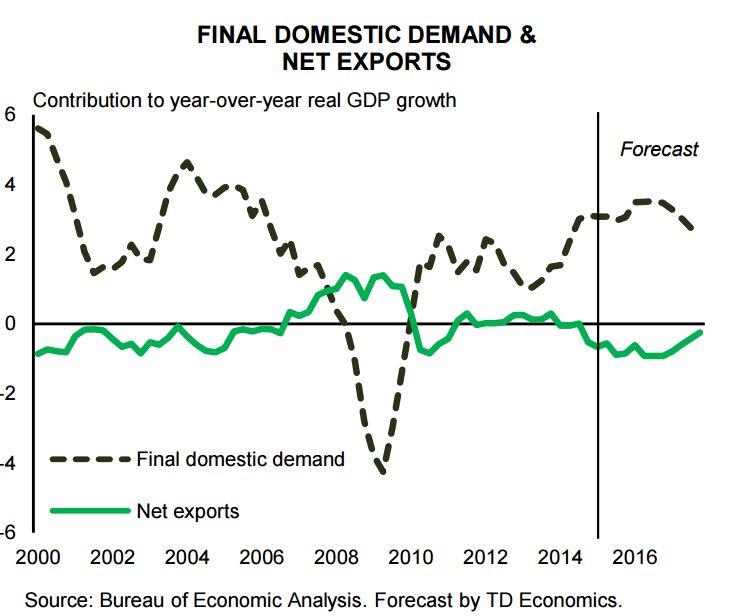

There is little doubt that the global economy is on a weak footing. And, there is evidence that this is weighing on U.S. growth. The international trade data out this week put this on full display. American exports fell 2.0% in August. In combination with a 1.2% rise in imports, the arithmetic is for net-exports to cut a full percentage point from real GDP growth in the third quarter. As a result, real GDP growth is expected to expand by just 1.5%, down about a percentage point from our expectation in September. However, the notion that external forces - the combination of more volatile financial markets, a higher dollar, and softening global growth - will reduce U.S. growth to the extent that it no longer makes progress on reducing unemployment is being overstated.

There are a few problems with the narrative that global growth will sink the U.S. economy that we think are worth pointing out. The first is that the shock from rapidly declining energy prices hurt U.S. economic growth before it began helping it. According to TD Bank, it bears repeating that the reduction in energy investment directly cut 0.5 percentage points from economic growth in the first half of the year. It will not do this again in the second half. The benefit to consumers, on the other hand, will continue well into the next year. And overall, these benefits are bigger - the increase in spending due to lower energy prices is likely to lift GDP growth by 0.7 percentage points over the next year. What is true of the U.S. economy is true of the global economy at large - the overall impact of a fall in energy prices is positive for global growth, but not at first. Some of the weakness that we've seen to date will be reversed as the income transfer from energy producers to consumers shows up in demand.

The second problem with the global economy taking down the U.S. is that America is a large and still relatively closed economy. Yes, trade has been increasing in importance, and yes, China is much more important to global growth than it was even a decade ago, but the reality is that exports make up less than 13% of U.S. GDP. Among G-20 countries, this is the second lowest share, just slightly above Brazil. Imports are higher at 16%, but, as the chart above illustrates, the negative contribution from net-exports is dwarfed by the positive contribution from spending within America. Lower import prices help domestic demand, and also give support to production elsewhere in the world, helping to offset some of the other downside risks to global growth.

The bottom line is that some of the pessimism on the U.S. economy from global influences appears to be overstated. With domestic demand slated to remain robust, the job market will continue to improve, inflation will begin to inch higher, and the Fed will begin raising interest rates, added TD Bank in the report.

U.S. growth outlook still intact

Sunday, October 11, 2015 11:50 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022