- US housing market is recovering but in divergence and still remain much weaker than pre crisis level.

- US housing market improvement was supported by near zero interest rate by Federal Reserve (FED). However since last year mortgage market rates have gone up especially the longer dated fixed rate as speculation rose that FED will tighten policy this year.

Affordability -

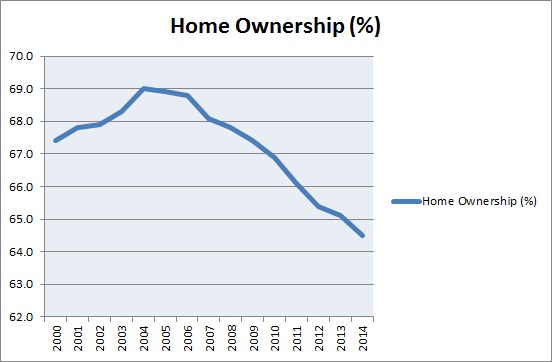

- Low home ownership - FED started lowering rates at the height of crisis in 2008, when unemployment remained near 10% level. Housing would have been last thing on mind of consumers, who deterred from big time investments. Actual benefit was for companies that used lower rates to buy houses and rent them away. As an evidence of this is US home ownership, that is actually going down and hovering below 65% when for developing economies like India, rate is much higher above 80%. Private equity firms are now the largest landlords in US.

- Outside ownership - Rich from the emerging economies namely China has seized the opportunity of lower rates in US and has increased holdings in the housing market. The lower rates actually failed to help common people any big way.

These factors resulted in upward movement of price. Higher price only helped to improve the mortgage value to loan ratio, but seized away the affordability from general consumers.

- Lower wage growth - US wage growth has remained stagnant since 2010, despite big fall in unemployment rate. Since 2012 wages are up only 1.3%, whereas house prices soared more than 17%, according to RealtyTrac.

- In some cities home sales are down close to 30%, however prices registered rise of 16% YoY.

- Income inequality has remained another issue in improving affordability. People with access to cash and assets as a whole earned much more as QE fueled asset prices namely large appreciation of stocks.

US Federal Reserve members might take these developments into account and keep the pace of hike at much lower level, unless significant improvement is registered in wage growth or else higher mortgage rates will push home affordability lower.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate