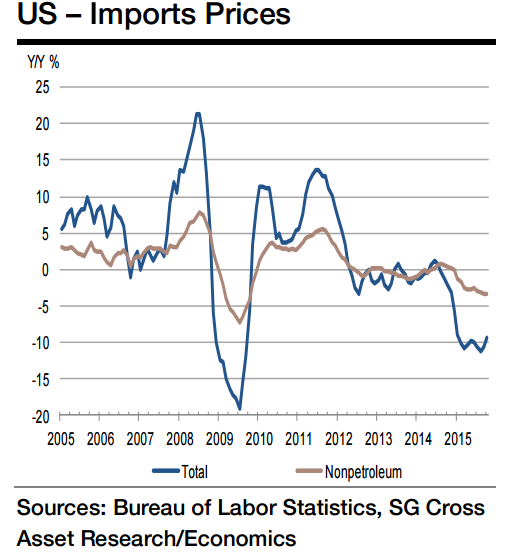

A tug of war between firmer petroleum quotes and lower costs for other foreign goods probably left the Import Price Index (IPI) 0.2% higher in October, following a 2.7% decline over the July-September span. The IPI oil-price gauge is expected to have risen by 4.2% during the reference period, adding four ticks to the headline reading last month.

Reflecting the lagged impact of a firmer dollar and weaker metals prices, the IPI excluding petroleum products likely dipped by 0.2%, boosting the cumulative decline since the end of 2014 to 3.1%.

"Our forecasts, if accurate, would leave the overall and non-oil IPIs 9.2% and 3.4% below their respective year-ago levels", notes Societe Generale.

US import prices expected to rise for first time in four months

Monday, November 9, 2015 9:27 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX