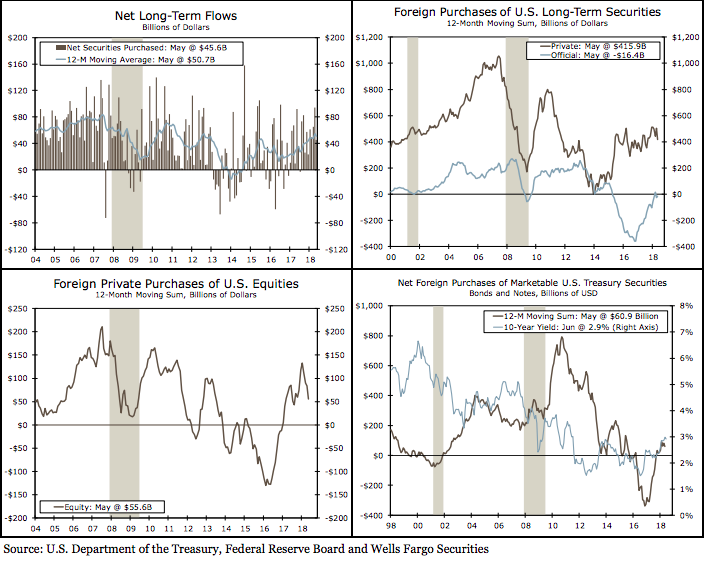

The United States’ net foreign purchases of long-term securities slowed in May, although foreign private institutions are still willing buyers of U.S. Treasury and corporate debt. Foreign official institutions remained net sellers in the month.

Net buying increased a smaller USD45.6 billion, down from April’s USD94.0 billion jump. Foreign private buyers accounted for all of the long-term gain, as foreign official institutions continued to be net sellers in May. Foreign private buyers continue to unload equities, selling a net USD27.8 billion in May, the largest outflow since 2007.

Foreign private buyers continue to have a strong appetite for long-term U.S. Treasury securities, with net foreign private purchases rising USD50.5 billion in May, on the heels of a similarly solid USD43.5 billion increase in April.

"Capital inflows remain relatively healthy; but, as trade rhetoric has heated up more recently, we will be watching for how this impacted demand for U.S. securities in June," Wells Fargo Securities commented in its latest research report.

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions

Oil Prices Slip as U.S.-Iran Talks Ease Middle East Tensions  Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment

Asian Markets Surge as Japan Election, Fed Rate Cut Bets, and Tech Rally Lift Global Sentiment  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk

Asian Currencies Stay Rangebound as Yen Firms on Intervention Talk