The non-manufacturing sector of the United States surged during the month of November, while the services equivalent witnessed the highest rise in over a year, with the former largely beating market expectations.

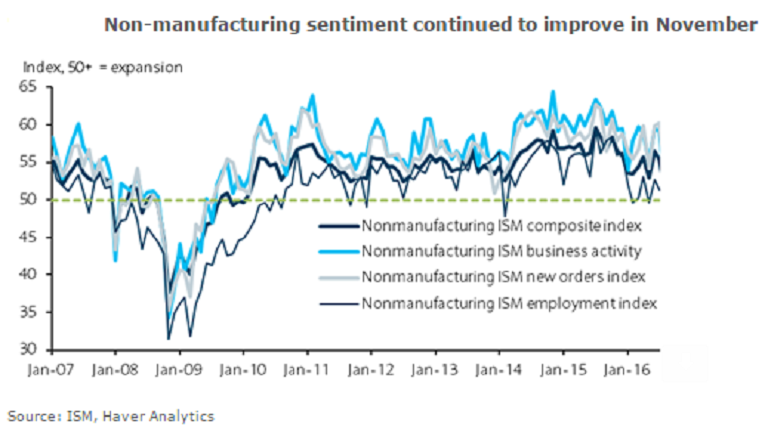

The ISM nonmanufacturing index jumped to 57.2 in November, from 54.8 in October. U.S. service providers experienced a robust expansion of business activity in November, helped by the fastest rise in new work for one year. The seasonally adjusted final Markit U.S. Services Business Activity Index registered 54.6 in November, to remain above the 50.0 no-change value for the ninth consecutive month.

Further, at 54.9 in November, the seasonally adjusted final Markit U.S. Composite PMI Output Index was unchanged from October’s 11-month high and therefore signaled a further robust expansion of private sector business activity.

In addition, all activity components now indicate solid service-sector activity. Business activity (61.7) rose to the high end of its post-recession range, and the employment index surged to 58.2 (previous 53.1). Combined, the series point a near-term acceleration in the services sector.

"The solid business survey readings not only add to the widely held view that the Fed is near certain to raise interest rates at its December meeting, but also raise the prospect of more aggressive than previously anticipated interest rate hikes in 2017," said Chris Williamson, Chief Business Economist, IHS Markit .

Meanwhile, the dollar index has formed a doji at 100.15, up 0.06 percent at the time of closing on the New York Stock Exchange (NYSE), while at 4:00GMT, the FxWirePro's Hourly Dollar Strength Index remained slightly bearish at -77.47 (a reading above +75 indicates bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock