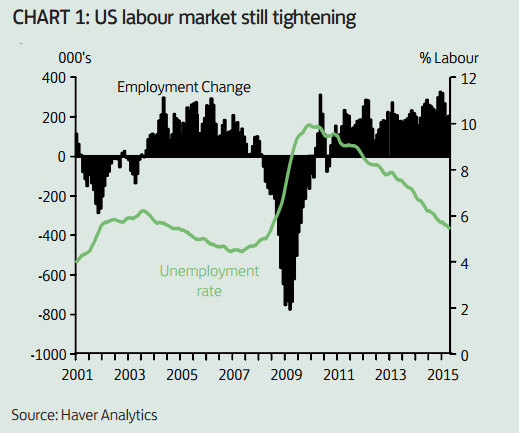

The coming week is an important one for assessing the extent to which US economic growth is picking up in Q2 following its weak start to the year. Other indicators suggest that the labour market has continued to tighten in recent weeks.

The Fed's identification of further labour market improvement as one of the key preconditions for a hike in interest rates means that Thursday's payrolls report - published early due to the Independence Day holiday on Friday - will be particularly eagerly awaited.

"With initial jobless claims remaining low during June, we expect a 235k rise in employment, while the unemployment rate is forecast to dip to 5.4%, and earnings growth is expected to remain stable at 2.3%." estimates Lloyds Bank

US payrolls report to show labour market is continuing to tighten

Friday, June 26, 2015 5:04 PM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed