Personal consumption, income data along with PCE price index would be released from US at 12:30 GMT.

Why it matters?

- Personal consumption and income data provide information on consumer sentiment. Consumers tend to spend more, should they perceive upcoming time to be favorable.

- Increase in income also improves sentiment and purchasing power of consumers.

- PCE price index or PCE deflator is FED's preferred measure of inflation indicator. So this gauge is of extreme importance as FED's price stability mandate makes inflation is of higher priority as of now. Jobless rate is already near FED's longer term target level.

Past trends -

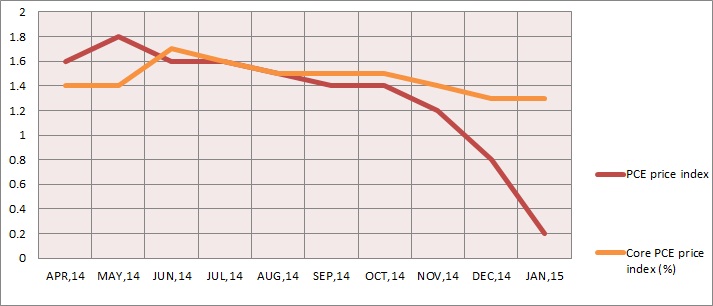

- PCE deflator had been gaining last year, however started going down in latter half of the year as oil price fell close to 50%. In January PCE price index grew just 0.2% YoY but core PCE deflator remained at 1.3% YoY. PCE deflator path is explained in chart.

- Personal income growth has remained positive since 2013, however at subdued pace. In January income rose by 0.3%.

- Personal Spending fell by -0.2% in January, this was second consecutive fall.

Expectation today -

- Personal income and spending, both are expected to grow by 0.2% and 0.3% respectively.

- PCE deflator core is expected to gain by 0.1% mom, however headline might move into negative territory.

Market impact -

Dollar is doing well against counterparts today. Dollar index is trading at 97.83, up 0.5% today.

- Improved dockets with a rice in core PCE deflator would further energize the dollar, however a sharp drop in PCE deflator especially the core would pose challenges.

- Any large selloffs in dollar is not expected. Short term treasury gains might be large over higher core PCE price increase.

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?