Personal consumption, income data along with PCE price index would be released from the U.S. at 12:30 GMT for the month of April.

Why it matters?

- Personal consumption and income data provide information on consumer sentiment. Consumers tend to spend more, should they perceive upcoming time to be favorable.

- Increase in income also improves sentiment and purchasing power of consumers. Over the last two years or so, the Federal Reserve has repeatedly said that the income growth has been robust.

- PCE price index or PCE deflator is the Fed’s preferred measure of inflation indicator. So this gauge is of extreme importance as the Federal Reserve members will be closely monitoring inflation for subsequent hikes. Fed has increased interest rates by 25 basis points thrice in 2017 and four times in 2018 and reduced its forecast from two hikes to no hikes n 2019. However, as the Fed is in a wait and watch mode, the actual numbers of hikes would be very much dependent on actual inflation.

Past trends –

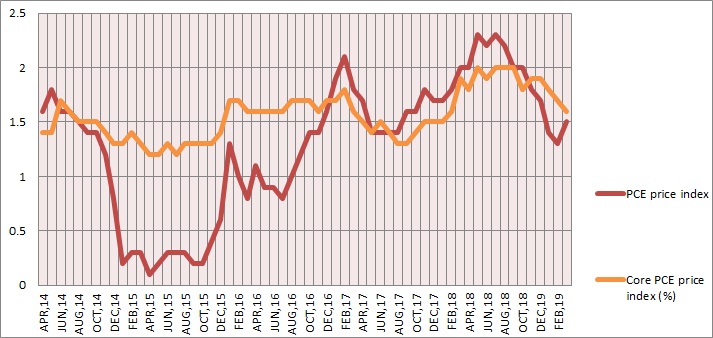

- PCE price index, largely due to the oil price, started falling from 1.8 percent y/y in mid-2014 to as low as 0.1 percent y/y in June 2015. It started recovering since November 2015. After rising steadily through 2016, PCE inflation has once again come under pressure in 2017. PCE inflation declined from 2.1 percent in February to 1.6 percent as of September 2017. It has been growing since. In March 2019, PCE inflation was at 1.5 percent y/y, down from its 2 percent peak in September 2018.

- Income growth has declined. In March, growth was only 0.1 percent.

- Spending has picked up. In March, spending grew by 0.9 percent.

Expectation today –

- Personal income is expected to grow by 0.3 percent in April, while spending is expected at 0.2 percent. PCE index growth is expected at 1.6 percent y/y.

Market impact –

- With market not agreeing to the forecasted path of rate hikes, inflation is going to be the single most crucial factor in determining actual rate hikes. A better than expected income and spending numbers likely to boost the S&P 500 and the dollar, which are currently trading at 2788 and 98.06 respectively.

- Whereas a worse than expected report would drag S&P500 down but USD is likely to receive bids.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed